Being self-employed in Germany is not easy. Generally speaking, Germany’s laws, regulations and social systems are more focused on workers with a fixed contract and a steady employer. Which often leaves the self-employed neglected. A situation that could be turned into a benefit, if the right measures are set in place, and you know what to do.

This will give you a comprehensive introduction to being self-employed in Germany. Covering the advantages and disadvantages, things to watch out for, and how to profit from your self-employment. No matter if you are already self-employed or are just thinking about becoming one in the future, the information will help you to make better decisions for yourself. This knowledge may be useful whether if you are in a fixed contract, giving you with a better understanding of your own position and your self-employed retirement plans. If you have more questions after reading it, do not hesitate to contact us!

Self-employed benefits and drawbacks

As already mentioned, being self-employed in Germany, you will have less access to state support and will have to take your own precautions. But the positives, you will pay less money into state-mandated insurances and schemes. Resulting, your net income will be higher than that of a comparable salary-based employee.

Coworkers with fixed agreements do not have to worry about a whole collection of predicaments and risks. They are already covered. But what are the services in question?

Unemployment insurance

Self-employed people in Germany do not enjoy the same protections against unemployment, there are no self-employed benefits if they find themselves out of work. To understand this problem, we must look into the social security system in Germany.

For the normal employee, there are two stages of support: unemployment insurance and social services. As soon as the employee is out of work, they can apply to receive benefits from their unemployment insurance. With the requirement of at least 12 months employment, upon acceptance, they’ll get financial aid for the next 12 months. The amount is dependent upon previous wage and expenses. At the same time, public health insurance is also paid, and the year counts as a “Wartezeit” for his state pension. Altogether, this time under “Arbeitslosengeld I” tries to mimic a regular employment, facilitating a smooth transition into their next job.

Social insurance

If you are unsuccessful in finding a new job, the benefits will be lost after 12 months. Along with support payments, and health insurance must be financed out of his pocket. The only support is social service. This money is officially called “Arbeitslosengeld 2”, better known as the infamous “Hartz IV”. To receive it, you must prove that you are in need and without income. All assets and savings must be declared. The amount of this payment depends on the rate set by the government.

Being self-employed in Germany, you will not have access to “Arbeitslosengeld I” and their associated benefits. Instead, you will immediately fall into the second category. You can only save and hope that your savings investments are enough to carry you through the drought. Managing your finances, and making your own money work are essential for anyone who is self-employed in Germany, especially if you are planning for retirement one day.

Self-employed retirement plans

Besides forfeiting unemployment insurance, fewer things have a bigger impact than the disconnection from the state pension system. Most Germans rely on the state pension scheme. Not only to receive a payment in old age, but also to secure their spouse’s financial future and to get support if long-lasting illness befalls them. The possible services of pension insurance are capable of covering all these topics. It is also normal to take out private pension insurance as an additional measure, closing the gap between wage and retirement income.

Retirement savings for self-employed

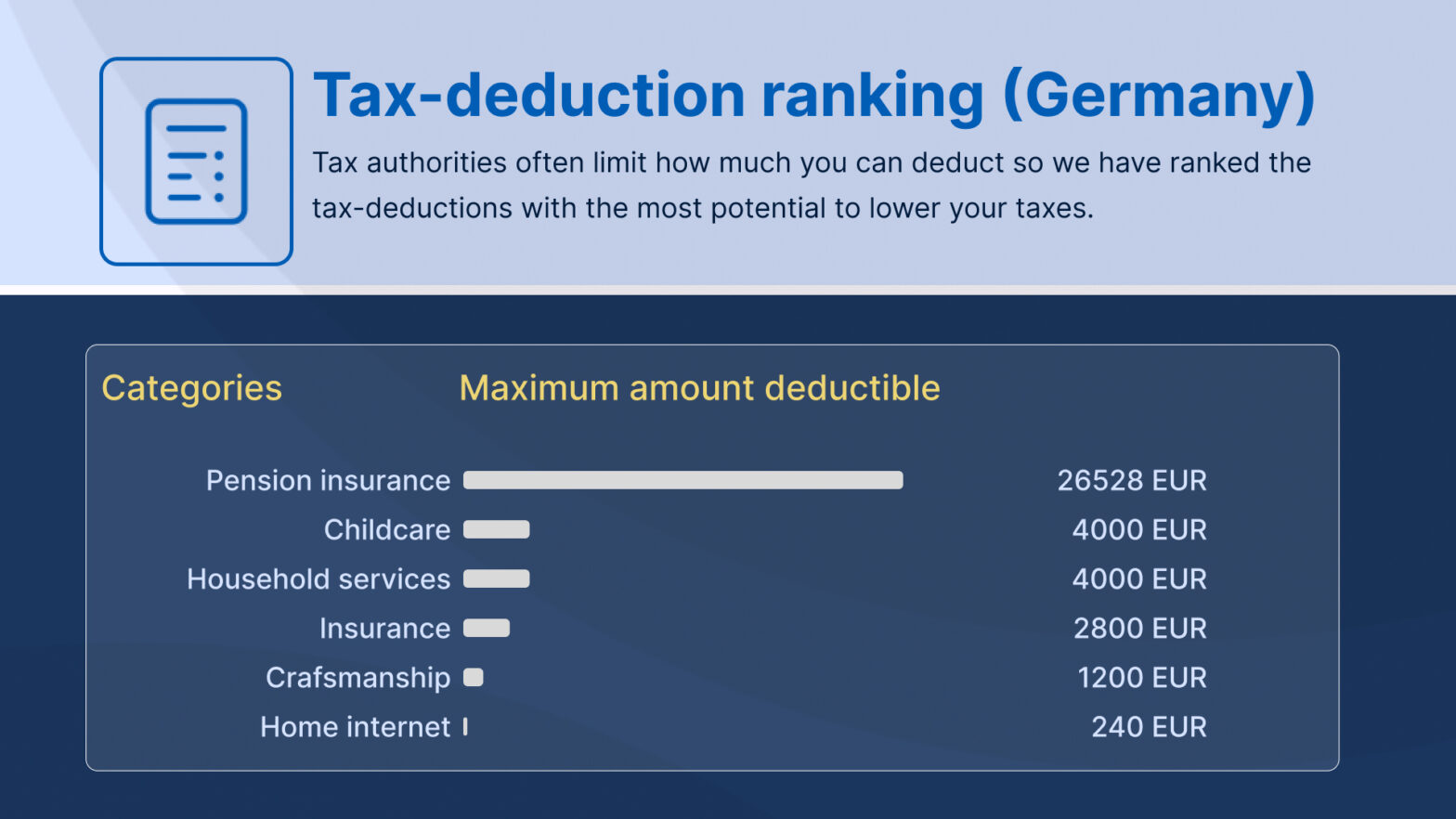

Retirement saving schemes for the self-employed are made under different circumstances. They are not required to pay into any pension scheme, it is completely voluntary. Usually, the most important factor during creating a retirement fund for the self-employed is to maximize the leverage of tax deductions. Since the self-employed in Germany do not have the burden of several state-mandated insurances on their back, they often enjoy a higher income, with higher taxes. Many self-employed in Germany, therefore, turn to pension insurances that use dedicated tax breaks, refunds and incentives; currently there are 2 products suitable for this.

The state pension scheme for self-employed

Less popular today than it was, voluntary contributions to the state pension system are still viable for saving taxes, whilst building up a retirement fund. Every resident over 16 years old can contribute money into the national pension scheme. In exchange for these payments, you are eligible for a lifelong pension after reaching your 67th year.

The amount you receive depends on the total sum you paid in. The more invested, the higher income later. The amount you contribute is flexible, and you can decide on a monthly amount to pay. There are lower and upper monthly limits on the contribution size, between 83.70 Euro and 1,311.30 Euro. You then get access to all benefits and services provided by the state pension system. Such a retirement fund to support you in case of prolonged illness or disability. Meanwhile, the money is locked in and can not be removed in case of bankruptcy.

Alternatively, you are directly buying into a pension scheme, heavily dependent on the contributions of the next generation and health of the German state. This cannot be protected against inflation, making this potentially less desirable.

The Rürup-Rente for self-employed

Recently, the Rürup-Rente became a favorite among the self-employed in Germany. Given that those self-employed in Germany don’t have access to most other pension products gives this product a clear advantage. It has a simple elegance and a great amount of flexibility that allow a personal investment strategy’s easy and inexpensive implementation. The underlying principle is straightforward. The investor contributes to the pension. This money can be deducted from taxes paid.

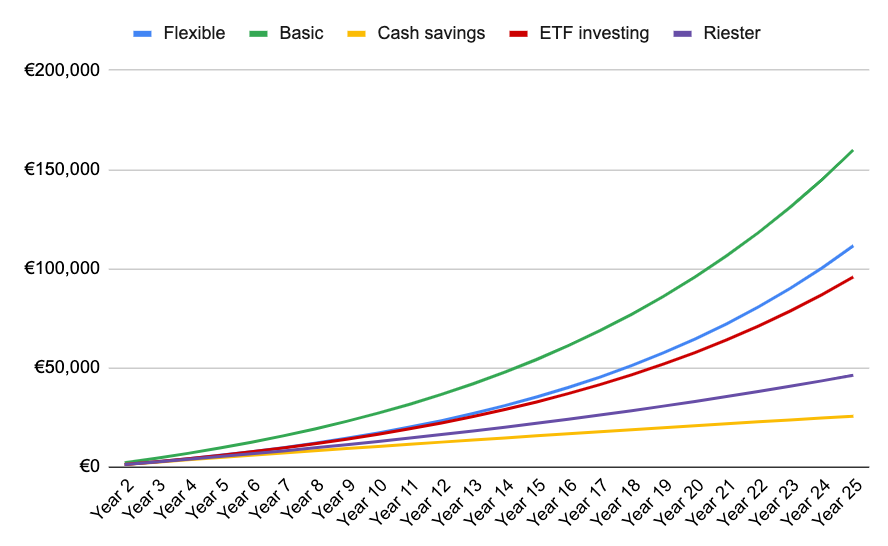

Inside the pension, funds will be invested according to the wishes of the investor. Generated profit remains within the contract and will be reinvested. At the end of the agreed duration, the funds are used to finance a lifelong personal pension for the retiree.

Flexible contributions

Along with the benefit of reducing taxes, the Rürup-Rente gives great flexibility of payments and contributions. Every year, the investor can put as much as 25.787 Euro into the contract or 51.574 Euro if it is a married couple contract, which is tax deductible. With flexible payments being able to be made, monthly or via a lump sum, it is possible to create a good retirement income in a short time.

It is even permitted to stop the payments and let the pension portfolio grow with the amount already invested. The tax savings depend on the personal band of taxation. But for the self-employed in Germany, paying 30% or 40% in income tax is not uncommon. The Rürup Rente allows you to save some of this money.

Free choice of investment

Alternatively, you can choose an investment according to your wish. An equity-focused fund in ETFs is possible, fixed interests or defensive strategies funds. As long as the provider offers it, the regulatory requirements are not as tight as other products.

The locked-up money

While you save the taxes during the investment phase, the disadvantages are the full pension amount becomes taxable income upon receipt. Essentialy shifting your tax burden from the present to the future. As retirement income is lower, with lower taxes, it is worth considering. More critical, is the rigid nature of the money. A Rürup Rente only has a single purpose: financing a lifelong pension. Once invested, this money is locked-up and can no longer be withdrawn.

Also, it is impossible to end the contract or demand a lump-sum payment instead of your pension. With these issues being the same as the state pension, the Rürup Rente is more beneficial. With these issues being the same as the state pension, the Rürup Rente is more beneficial.

Self-employed insurance plans

Besides retirement, the most important problem for the self-employed in Germany is having a sensible insurance plan. Many risks that employees can ignore, require additional attention for the self-employed and further safeguards.

Self-employed liability insurance

Most Germans will have private liability insurance, with self-employed Germans being no different. However, they have to consider their liability risk at work. Getting sued by a customer can cause financial ruin, even if the claim is without merit. Everyone, self-employed in Germany should supplement their private liability insurance with insurance specific for their work, along good legal insurance.

Disability insurance for self-employed

Most employees rely on the state pension for this for disability or long-term illness. Usually, the amount of help is overestimated. A wise choice for everyone who is self-employed would be to get private work and disability insurance (Berufsunfähigkeitsversicherung/ BUV).

Taking out disability insurance for the self-employed will pay out monthly, if the insured person should be unable to work. It protects against most diseases and disabilities and is easier to qualify for, than for the state pension, whilst also paying a substantially larger amount.

Can I get a mortgage being self-employed?

It is not easy to get a mortgage if you are self-employed, but it is possible!! The important thing is to prove to the bank, or the financial institute, that you have a steady income and can pay the mortgage rates. Usually, you have to present the books and tax receipts over the last 3 years.