Introduction

At Horizon65 we have built an advanced financial simulator that takes into account the tax code in Germany and all the available investment products and by doing this and running many simulations we realized that you can leverage tax deductions to accelerate your savings to the extent that you can probably retire early by investing relatively low amounts (at least if you are still young).

Tax-accelerated investing works in many countries, but this article is focussed on Germany.

What is tax-accelerated investing

The German government provides tax-incentives for people to save for their old-age and gives many tax breaks when you sign up to tax-advantaged investment contracts.

They do that because due to the constantly improving healthcare, people live much longer and due to the declining birth rates among the population the ability of the state to provide adequate pensions is declining. German politicians tend to increase the retirement age every 3 years, but they also installed a system of points which can be revised at will which enables the state to lower your pensions when they have to.

Fundamentally they do that because state pensions are paid from the current government budget and they do not actually set money aside to invest in your future. They spend the money as it comes in, which has worked well in the past when the population was increasing. However that demographic trend has reversed and since the problem is in the future, politicians have opted to hollow out the state pension system and instead provide a system where you can defer taxation on income you make today to when you retire.

Essentially, tax-accelerated investing allows you to invest from your pre-tax salary rather than the post-tax salary you receive every month on your bank account.

It is called tax-acceleration because using these tax breaks your investments can accelerate beyond anything you can do yourself.

The only catch is that this only works when you are saving for your (early) retirement.

Are we talking about the Riester pension?

No, the Riester pension also has tax-advantages but they are more like subsidies and that is not what we will talk about in this case.

For reference, the Riester pension is a state subsidized pension scheme that only allows you to invest in guaranteed investments with low risk, which unfortunately have a much lower performance than if you would invest it in the stock market. It works well for large families because you get a subsidy for every dependent and those subsidies are essentially free money.

In this article we do not talk about the Riester pension but rather about the Basic pension (Basisrente) which is a scheme originally designed for the self-employed but now available for everyone.

We will also talk about the flexible pension (private altersvorsorge) which is a tax-sheltered investment scheme that works for expats worldwide.

Impact of tax acceleration vs. other investment options

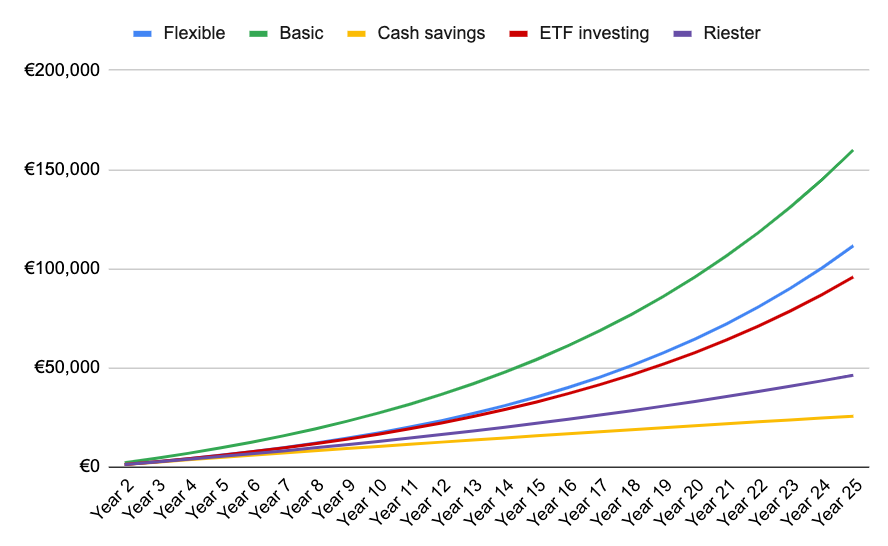

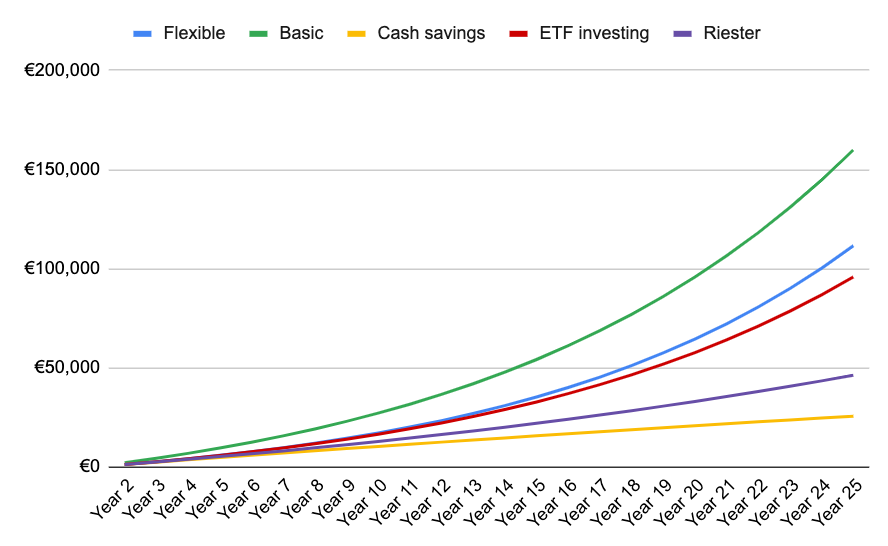

In the graph below you can see the impact of tax-accelerated investing as marked by the two tax-advantaged systems we will talk about: The basic pension and the flexible pension savings scheme.

We compare it to ETF-investing, which is a passive stock-market index investment scheme that has historically performed very well. However, ETF-investing has no real tax-advantage in Germany although some of them do report taxes automatically to the German authorities. That is however, tax-convenience and does not allow you to gain money.

We also compared it to saving money in the bank, which is a very popular option among people who are not willing to invest.

The difference is huge because the taxation on your salary is very high but also because of the compound interest effect.

Compound interest basically means that you start to make money on the profits from last years’ investments.

Einstein understood what this meant:

How does it work?

Tax-accelerated investing works by investing from your pre-tax salary instead of your post-tax salary which is possible through the basic pension system (basisrente or rürup).

Originally designed for the self-employed but then expanded to everybody in 2018, the basic pension allows for full investment flexibility including stock market indices like the S&P500.

Essentially, the rürup is a tax-deferral scheme that allows you to lower your taxable income.

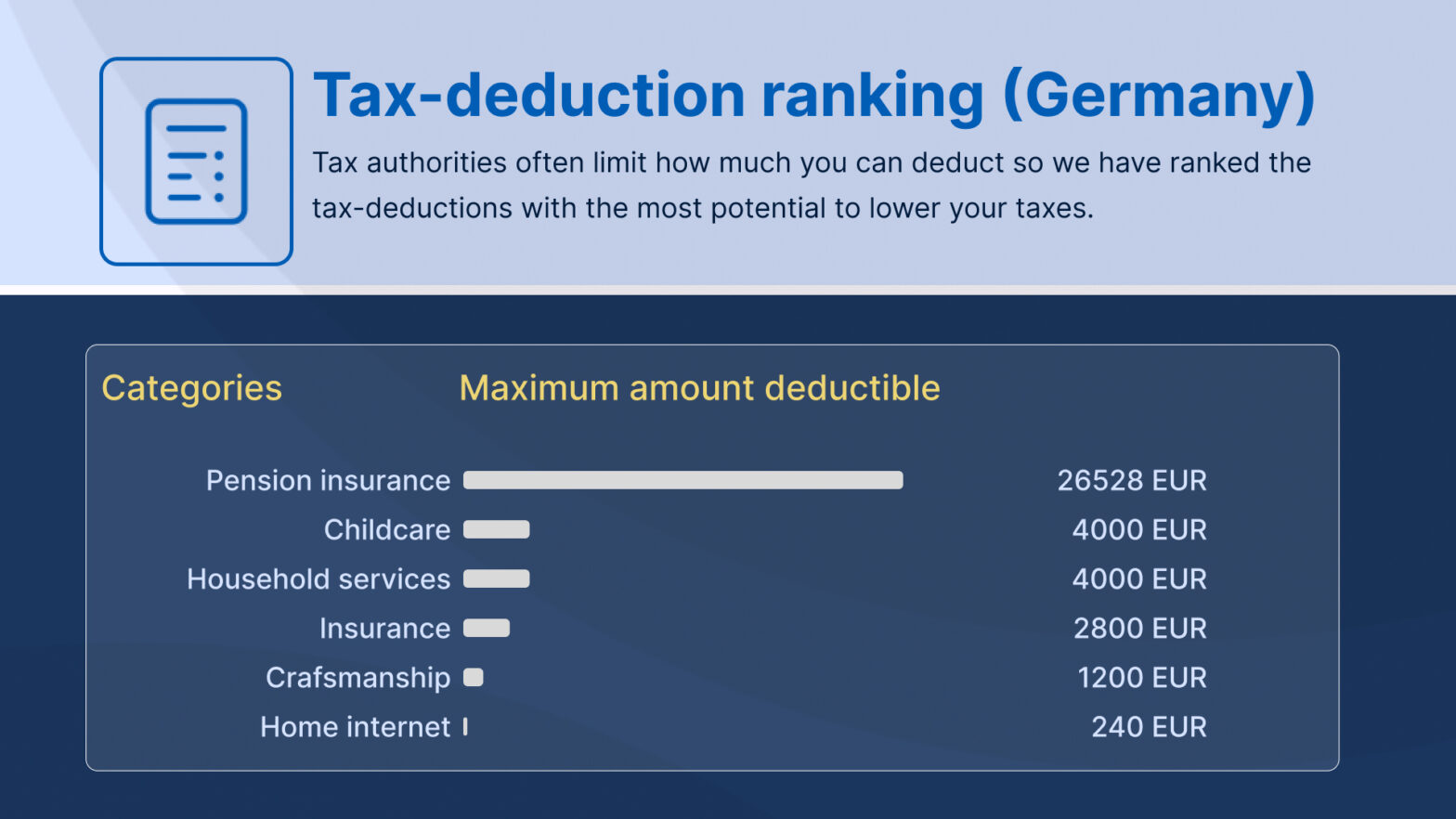

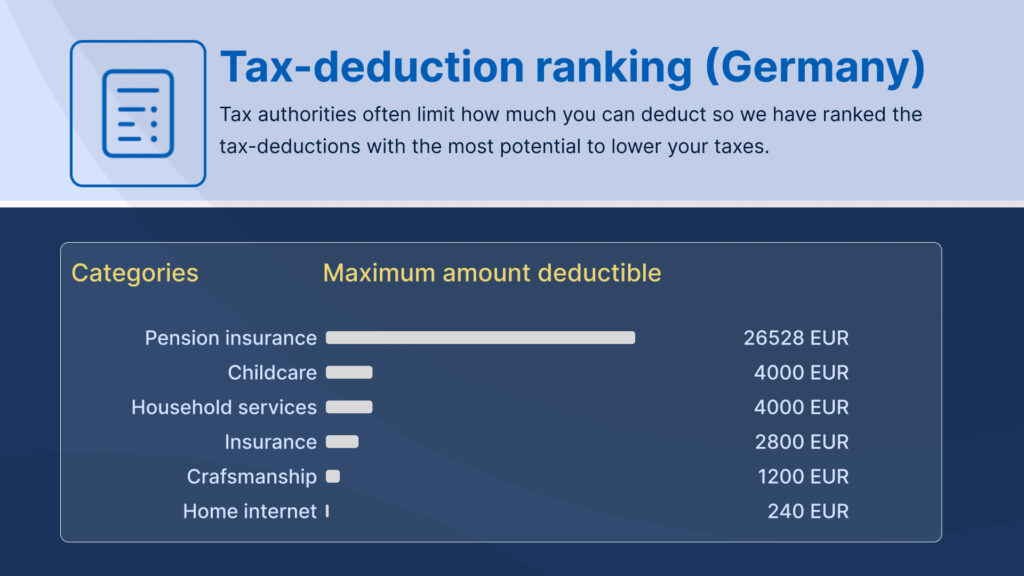

In fact, it is the highest possible tax-deduction you can have in Germany.

The basic pension allows you to deduct up to 26,528 eur if you are single and 54,184 if you file taxes as a married couple.

What is a tax-deductible?

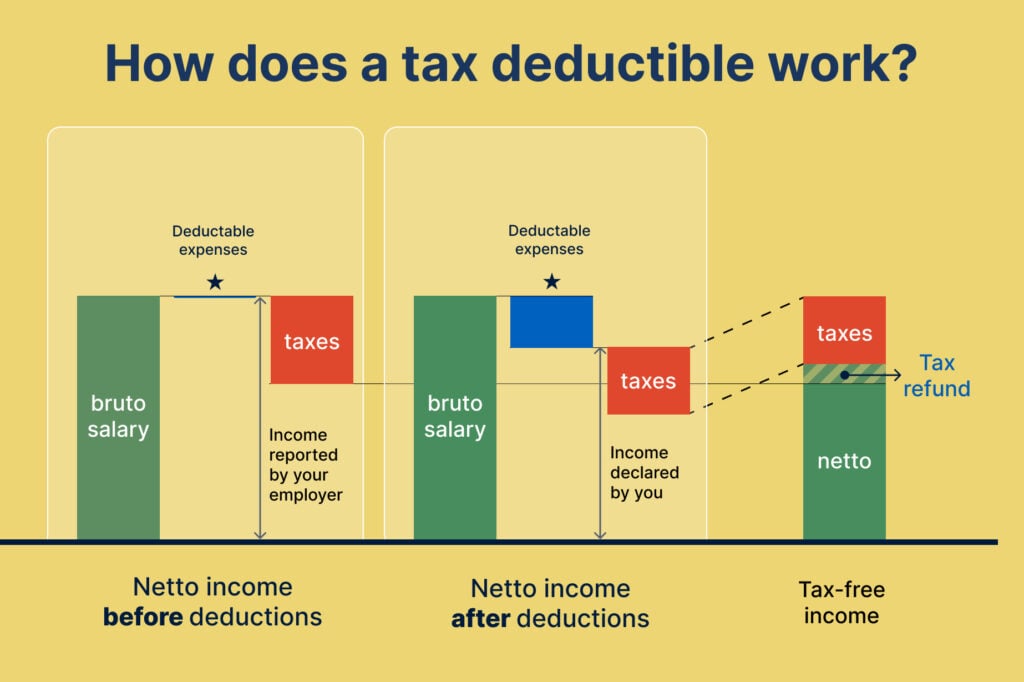

In essence, a tax-deductible allows you to lower your income that is considered when calculating how much taxes you have to pay.

When you are an employee, your employer already pays your share of taxes to the government and if you don’t have any tax-deductibles than that amount would be correct. However, if you do have tax-deductibles then you have to file a tax declaration to claim money back.

This results in a tax refund as illustrated below:

How do I use tax-deductibles to accelerate my investments?

When you invest in a basic pension, your investment can be tax-deducted.

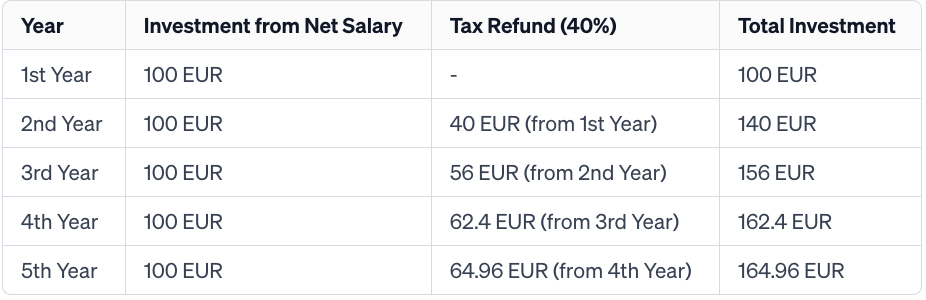

When you receive your tax-refund in the subsequent year, you can reinvest this tax refund into the basic pension which means you will not only invest more but also, you will get a higher tax refund the next year.

If you do this for several years, you will have transitioned from investing from your netto salary to investing from your brutto salary.

Here’s a table to illustrate this:

Note: this table assumes you are earning above average as your highest tax bracket is 40%

As you can see, starting this process earlier rather than later will literally save you a lot of money

But the tax refund is not the only advantage, a basic pension is also tax sheltered.

A trait it shares with the flexible pension.

What is tax-sheltered investing?

Essentially when you invest directly into stocks or other investments, when you receive dividends (profit distributions) or you have gains when you sell the investment (capital gains) then the Finanzamt will want 25% of those gains.

However, if you hold those investments indirectly through an investment contract then you don’t actually receive those gains in personal name, the contract manager receives those gains but they are not yet paid out to you.

This allows you to escape both capital gains tax (25%) and dividend income tax (25%).

What if I am not sure if I want to stay in Germany

This is a question that many expats struggle with as many may want to return to their home country or move to other countries.

The reality is that the tax refund can be claimed for every year you are working in Germany, which means that you are leaving money on the table.

You can just stop investing into the contract and then the money invested in it will keep growing, however depending if you take the flexible pension plan or the basic pension plan you will be able to keep investing in it even when you are no longer living abroad.

Conclusion

Tax-accelerated investments can make a meaningful difference in your financial future.

At Horizon65, we have helped hundreds of expats to take full advantage of the German tax laws and as we are a fully independent broker we can explore which providers are the most suitable for you.

We can do this either in a free initial consultation or you can compare the different plans yourself through our comparison portal.

We are also building an app where you can do everything on your own which is free of charge.

Check basic pensions available to you

Find out which basic pension plan is right for you on our comparison portal.