Introduction

When it comes to retiring comfortably in later life, it’s a no-brainer that you need to invest now. As people in society live longer lives, the state pension alone is not enough to ensure a comfortable retirement.

One of the most popular ways to save for your retirement is to invest in the stock market. This can be done either directly through stocks or indirectly through stock exchange-listed index funds – known as ETFs.

Many finance professionals agree that the time horizon over which you invest is an important factor in planning your investments.

This is something we will explain in this guide. This ultimate guide to retirement covers active vs passive stocks investing, the risks to consider as well as the benefits and drawbacks of different stock market investment types available to you.

Active investing vs. passive investing

Active stock investing and passive investing are two popular investment strategies. Both approaches have their advantages and disadvantages, and choosing the right one depends on your investment goals, risk tolerance, and time horizon.

Active Investing

Active investing involves buying and selling individual stocks or other securities in an attempt to outperform the market.

Who are active investors?

Active investors believe that they can identify undervalued securities and take advantage of market inefficiencies to generate higher returns. Active investors often rely on their skills in market analysis and stock picking to make investment decisions.

Active investors can be amateurs, professionals or thesis-driven investors that have a method of selecting certain stocks over other stocks.

What are the advantages of active investing?

One advantage of active investing is the potential for higher returns. Skilled active investors can identify opportunities that the market may have overlooked, resulting in higher returns.

Active investors also have more flexibility in choosing which securities to invest in and can adjust their portfolios as market conditions change.

What are the risks of active investing?

Active investors often pay higher fees for their investment management, which can eat into their returns.

Moreover, active investors must constantly monitor their investments and make adjustments as needed, which requires significant time and effort.

Another disadvantage of active investing is the risk of underperformance. Many active money managers fail to outperform the market, and those who do may not do so consistently. As a result, active investors may be taking on more risk than necessary without achieving higher returns.

Importantly, as active investing is considered to hold more concentrated positions, there is a real risk of ruin. Compared to a diversified investment approach, a concentrated, active investing approach is more vulnerable to total loss of investment if the investment item fails entirely.

Moreover, some active investors can also be prone to emotional biases, involving believing the hypes and selling on panic. Some stock investor clubs or individuals are convinced that they can time the market or identify patterns in stock price movements.

Passive Investing

Passive investing, on the other hand, is a strategy that involves investing in a diversified portfolio of securities that replicate a broad market index.

“The goal of passive investing is to match the performance of the market, rather than to beat it.”

What are the advantages of passive investing?

One of the biggest advantages of passive investing is its simplicity. Passive investors can buy and hold a diversified portfolio of stocks, reducing the need for constant monitoring and adjustment.

Additionally, passive investing typically has lower fees and is not subject to anti-speculation taxes, which can help boost long-term returns.

What are the risks of passive investing?

As passive investors track market indexes, they may miss out on potential opportunities for higher returns.

Additionally, passive investors are exposed to market downturns and may experience significant losses during times of market volatility. However, it is important to note that the impact of market fluctuations can be limited if you invest over a long time horizon.

Active vs passive investing: How do they compare?

As both strategies have been tried and tested for many decades, trends overwhelmingly point against active investing when it comes to long time horizons.

In the long run, passive investing consistently outperforms active investing.

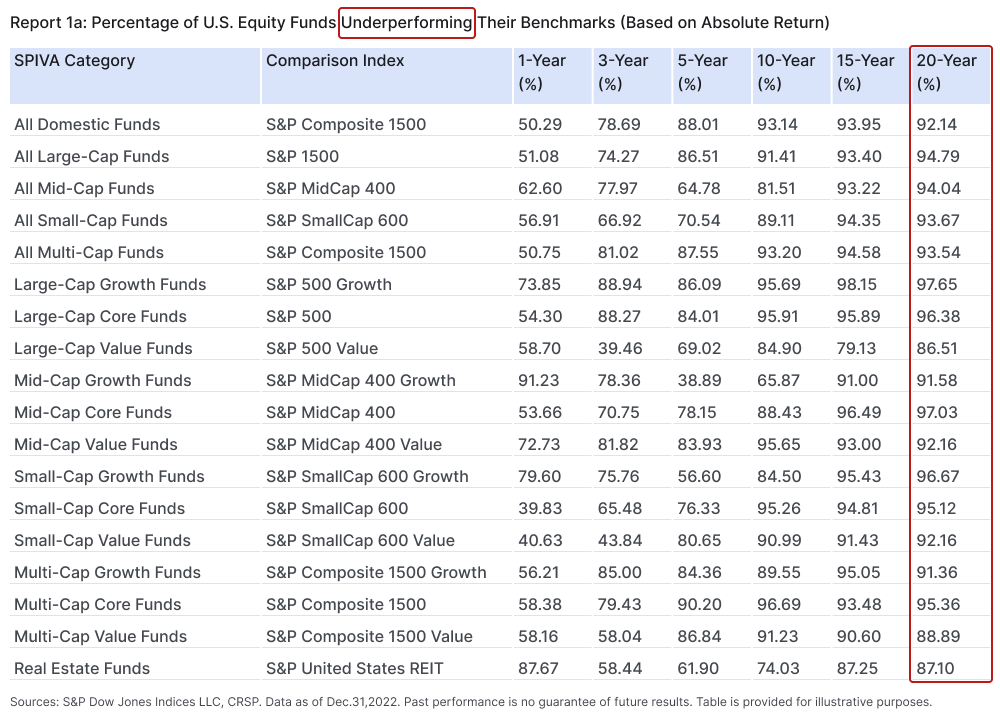

According to a study by Standard & Poor’s, over 90% of active money managers failed to outperform their benchmarks over a 20-year period.

Additionally, the fees associated with active investing can significantly reduce returns over time.

While there are skilled active investors who consistently beat the market, this tends to be more exceptional in nature, and not a general rule of thumb. As a result, many investors have turned to passive investing as a low-cost, low-risk way to achieve their investment goals.

Moreover, active investing can prove difficult for finance professionals who dedicate themselves full-time to it.

This is why a passive investment strategy for retirement investing is the best choice for most people.

You can see a chart of funds below that are managed by professional investors using active investing strategies compared to an equivalent passive investment strategy.

This table shows that 90% of funds with active investment strategies make less money than their passive benchmark equivalent after 20 years of investing

Risks with long-term investing in the stock market – and what can you do to reduce them?

Investing for your retirement is an important aspect of long-term financial planning.

However, investing doesn’t come without risks, and it’s important to understand the things that can lead to you losing money.

The following are considered the main risks you need to take into account which can lead to a loss of investment:

Country-specific risks

Major events can impact a specific country. Be it natural disasters, wars or changes in laws and taxation. Over a 25-year time horizon, a lot of things can change and risks that seem remote can materialise.

Industry-specific risks

Similar risks can be found when you look across an industry, The Covid-19 pandemic hit the airline industry hard and major events can impact entire industries in a negative way.

Company-specific risks

Almost all companies have unique specific risks that are hard to predict long-term. For example, the Tesla share price can fluctuate based on Elon Musk’s personal life, controversy and tweets.

When you consider that the average corporate lifetime is 20 years, it becomes clear that buying stocks with one specific company is like putting all your eggs in one basket. In other words, it’s best not to.

Concentration risk

Concentration risk is the risk of losing money due to having too much of your portfolio in a single stock or sector – the “all of your eggs in one basket” problem.

This means that you can lose your investment if you only buy stocks in a single company that happens to go bust. Similarly, if you have a large portion of your portfolio invested in a single industry or sector, you could be vulnerable to market volatility in that sector.

To mitigate concentration risk, it’s important to diversify your investments across a range of stocks, sectors, and asset classes. This can help spread your risk and reduce the impact of any single stock or sector on your portfolio.

Timing risk

Stock markets are famous for their ups and downs. This doesn’t necessarily hurt your retirement, but it can however significantly delay your retirement if you are unlucky due to a loss of investment.

This is a little-known downside of investing solely in the stock market for your retirement – and one of the biggest risks at that.

Loss due to taxes

When you sell an investment at a profit, you may be subject to capital gains taxes. Similarly, if you receive income from investments, such as dividends or interest payments, you may be subject to income taxes.

Some ETFs advertise themselves as tax shields against dividend taxation. However, this isn’t the case in Germany. In Germany, you are liable to pay taxes, regardless of ETF status.

This could put you in a vicious cycle position where you have to pay taxes – and then be forced to sell your stocks on top, triggering even more taxes.

The best way to defend against losses in tax is to use a private pension contract as a tax wrapper.

This means you are shielded from both capital gains tax and dividend income tax. Moreover, depending on the type of private pension contract, a tax wrapper means that you could also get a tax refund from your contributions.

Foreign exchange risk

Another important risk to consider is that most stocks are listed in US Dollars.

This can create unforeseen consequences when the currency exchange rate shifts or when US-listed run into trouble

This is why many ETFs in Europe include something called currency hedging – a form of insurance against currency fluctuations.

What can you do to avoid these risks? Diversify!

Being exposed to any of these risks can make your portfolio lose significant value in one year, meaning it could take your portfolio several years to recover.

That’s why the only reliable way to make money long-term on the stock market is to spread your money across as many stocks as possible in order to blunt the impact of any of those risks.

This is called diversification – a very important topic in long-term investing.

Thinking about diversifying for your retirement?

Understand your retirement investment options with one of our experts.

The benefits and drawbacks of different stock market investment types

ETFs

An ETF (Exchange Traded Fund) is a type of investment fund traded on stock exchanges – just like individual stocks. It pools together investors’ money to purchase a basket of underlying assets such as stocks, bonds, commodities, or currencies.

What properties can ETFs have?

ETFs can utilise the following:

- Currency-hedging

Some ETFs use currency-hedging strategies to minimise the impact of currency fluctuations on their underlying assets.

- Leverage

Some ETFs use leverage to amplify their returns by borrowing money or using financial derivatives. However, these can be risky for long-term investments as losses can be amplified in tough market conditions.

- Geographic priorities

Some ETFs focus on specific geographic regions or countries, such as emerging markets or developed markets.

- Accumulation or payout

Some ETFs distribute income to investors in the form of dividends or interest payments, while others reinvest the income back into the fund.

- Asset mix

ETFs can have different asset mixes, such as equity, fixed income, or alternative assets like commodities or real estate.

Pros

- ETFs offer a diversified portfolio with low management fees, making them a cost-effective retirement investment option.

- ETFs are traded on the stock exchange, providing easy access to a wide range of assets.

- ETFs can be easily bought and sold like individual stocks, offering flexibility and liquidity for retirement investors.

Cons

- ETFs may be subject to market fluctuations and volatility, making them riskier than other conservative investments.

- Choosing the right ETF can be difficult for investors without prior knowledge of investment analysis and market trends.

- Dividend income from ETFs is taxed.

- Capital gains from ETFs are taxed.

- Accumulation of dividend income is still taxed in Germany.

Did you know you can invest in ETFs through a private pension plan?

Find out how this works in our ultimate guide to private pensions.

Stocks

Stocks, also known as shares or equities, represent ownership in a publicly-traded company. When you buy a stock, you are essentially buying a small piece of ownership in the company.

Stocks are bought and sold on stock exchanges such as the New York Stock Exchange (NYSE) or NASDAQ, and the price of a stock can fluctuate based on supply and demand.

Pros

- Stocks have the potential for high returns long-term, making them a lucrative investment option for investors.

- Stocks can provide income through dividends and capital gains, which can supplement retirement income.

- Stocks offer investors the opportunity to invest in companies they believe in.

Cons

- Stocks are subject to market risks and volatility, which can result in significant losses.

- Choosing the right stocks can be difficult, requiring extensive research and analysis.

- Stocks require active management, making them a less passive investment option for retirement investors.

- Even when selecting well, the market may not agree with your assessment Income from stocks is taxed in Germany

- Capital gains from selling stocks is also taxed in Germany

Mutual funds

In this section, we’ll explore the many different types of mutual funds and summarise the pros and cons at the end.

What is a mutual fund?

A mutual fund is a type of investment vehicle that pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

The funds are managed by professional fund managers who use their expertise and research to select investments that aim to meet the fund’s investment objectives.

Investors purchase shares in the mutual fund, and the fund’s value is determined by the performance of its underlying assets.

What types of mutual funds are there, and who manages them?

- Thesis-driven funds

Thesis-driven mutual funds are those that invest based on a particular investment thesis or philosophy.

These funds are managed by portfolio managers who have a specific investment strategy or philosophy in mind. For example, a manager might believe in investing in companies that are undervalued by the market or have strong growth potential.

The manager would then invest in companies that fit this investment thesis, regardless of the sector or industry they belong to.

- Sector-specific mutual funds

Sector-driven mutual funds focus on investing in a specific sector or industry.

For example, a mutual fund might focus on the technology sector or the healthcare industry.

These funds are managed by portfolio managers who have expertise in that particular sector or industry and are able to identify companies with strong growth potential.

Sector-driven funds can be a good way for investors to gain exposure to a specific sector or industry without having to pick individual stocks.

- Index funds

Index funds track the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average.

These funds aim to replicate the performance of the index by investing in the same stocks or securities that make up the index. Index funds are passively managed, meaning that the portfolio manager’s role is simply to match the performance of the index rather than trying to outperform it.

Index funds tend to have lower fees and expenses compared to actively managed funds, making them a popular choice for many investors.

How do mutual funds overlap with ETFs?

In the US, ETFs often work as mutual funds themselves that are listed on the stock exchange – the difference is that they have significantly more reporting requirements.

In Europe, ETFs are often UCITS (Undertakings for Collective Investments in Transferable Securities) This means that ETFs in Europe are restricted transferable security investments (i.e. investments that are very quick to sell).

Mutual funds in Europe do not have this restriction. This means that they can invest in long-term projects, such as equity investments in infrastructure projects.

Pros

- Funds offer instant diversification, which helps mitigate risk and can provide a stable investment option for retirement investors.

- Funds are managed by professionals, who make investment decisions on behalf of investors, making them a more passive investment option.

- Funds can offer a variety of investment options, including equity, fixed-income, and balanced portfolios.

- Access to alternative investments

Cons

- Funds are subject to market risks and volatility, which can result in significant losses.

- Fees associated with fund management can erode returns in the long run.

- Choosing the right fund can be difficult, requiring extensive research and analysis.

- Less transparent than ETFs.

- No advantage over ETFs.

Do these stock market investment types give you tax advantages?

The short answer: No.

Stocks, ETFs, and mutual funds are popular investment options, each with their own benefits and drawbacks. Stocks offer the potential for high returns but come with high risk. Mutual funds provide broader diversification but come with higher fees and ETFs are low-cost and transparent alternatives but typically only invest in equities.

Neither option takes particular advantage of government-provided tax incentives for long-term investing.

If you want to find out how to leverage tax advantages with ETFs, our ultimate guide to private pension plans has you covered.

If you enjoyed this ultimate guide to investing in ETFs, stocks and mutual funds, check out further content in our ultimate guide series. Learn everything you need to know about real estate investing in our ultimate guide to real estate, find out about tax benefits available to you in our ultimate guide to the German pension system and how to protect yourself against inflation in our ultimate guide to inflation.

You can find all the content you need on our finance academy page.

Do you want to make the most out tax benefits via ETFs?

Talk to one of our experts and discover tailored investment options.