What is real estate investing?

Investing in real estate is very attractive in the eyes of many investors. It is very common and investing in real estate is seen as a generally secure investment.

In some cases, however, some who invest in real estate come to regret their decision later on. This is because they are inadequately informed about how much effort it really entails and what risks they will face.

When investing in real estate, you need to think through all the steps that you’ll need to carry out going forward.

This starts from the search for a property, the negotiations, the financing, the purchase, the repayment plan for the financing to the hassle of getting planning permission for modifications, not to mention the challenges that property development entails.

Last but not least, there are the challenges of finding a tenant and maintaining the property in a ready-state condition. Should you sell the property later on, the challenge of successfully selling the property (hopefully for a profit) also arises.

Despite the challenges, real estate investing is a time-tested way to build wealth and is a great way to invest for your retirement.

In this ultimate guide, we will discuss all the ways you can invest in real estate for your retirement as well as the ups and downsides of each type of real estate investment.

The different types of real estate investments

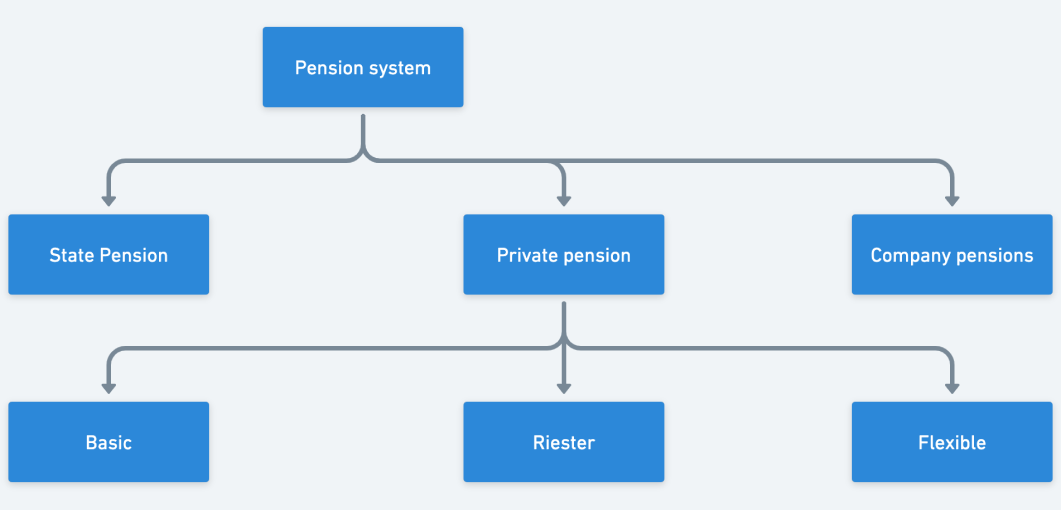

Real estate investments take many forms, from owning your own home to investing in a real estate fund. Generally speaking, there are 5 types of real estate investments we will discuss in detail here:

1. Buying your own home

Despite seeming daunting at first, purchasing your own home provides a lot of financial security and gets you on the property ladder.

Historically, owning your own home is generally a strong investment. However, owning your home in Germany isn’t as tax-efficient compared to some countries. In Germany, you cannot deduct maintenance costs from your own house from your income taxes. Luckily, you are able to reduce mortgage interest rates as well as property taxes.

2. Rental Property

Purchasing a property and renting it out to tenants is another popular real estate investment option. Rental properties can generate consistent cash flow and provide long-term passive income.

As a landlord, you’ll need to find tenants, collect rent, and make repairs as necessary. However, it is possible to hire a property management company to take care of this for you. Despite this, many rental property owners prefer to handle this themselves.

3. Purchasing Commercial Real Estate

Commercial real estate involves buying properties used for commercial purposes, such as office buildings, retail spaces, and warehouses.

Commercial properties can provide steady income from long-term leases with businesses, and the properties can appreciate in value over time. However, buying and managing commercial properties can be complex, requiring good market knowledge, expertise and are generally more expensive.

As you are dealing with business clients, your tenants will tend to act in a professional accord. This makes it easier to recover money should things go sideways.

4. Real Estate Investment Trusts (REIT)

If you want to invest in real estate but are not able to afford it yet, or you prefer to invest in real estate in a highly diversified way, investing in REITs is a good option for you.

Real estate investment funds pool money from multiple investors to purchase a diverse range of properties.

Investors can invest in these funds through a brokerage firm or financial advisor, and the fund managers take care of buying and managing the properties. This investment option allows you to diversify – without requiring you to manage individual properties.

5. Property Development

Property development involves buying a property and renovating it to sell or rent it out for a profit.

This investment option can be risky due to the high costs of building and developing property, while you also need to sell the properties for more than you spent to make a profit.

However, successful property developers can make considerable income and have a lot of control over their investment.

Main ways to make money with real estate

Whether you buy a rental property or renovate an old building, there are only a few fundamental ways to make money in real estate that you need to take into account:

Increase in market value

Improving the value and desirability of the property is a good way to make improve the value of your assets. However, you need to consider that the market still holds the cards here.

Why?

Property value is entirely based on market demand. Therefore, there is no guarantee your property will rise in value over time.

Market value can also be misleading. While some property owners believe their property is worth more than what it was 30 years ago, this illusion of the increase in value is often just down to inflation.

This is why you have to make sure when deciding to invest that the property value will increase from other factors, and not just inflation.

What can these factors be?

Factors can be things like demographic pressure (increase in population due to birth rates or immigration), improved transportation links, urban regeneration, proximity of new employers and general desirability for young families and students who will make up the future buyers of homes in this area.

Moreover, factors that can affect your property value in a positive way can also do the opposite – they can in some cases, decrease property value. Therefore, it is important to remain on top of trends and keep an eye on where the market is headed.

Market value can vary quickly and significantly. Executing property development projects to improve the value must be carefully planned and followed up so they stay within budget.

When considering property value, it is important to know the zone requirements (often regionally defined) and allowed uses from the local council.

For example, buying a forest and cutting down trees to build houses can sound like a profitable idea. This is however almost guaranteed not to be allowed by regulations.

Cash flow

Cash flow refers to the income that your property generates after you pay all of your expenses.

For example, if you own a rental property, your cash flow is the difference between the rent you earn and your expenses (such as mortgage payments, property taxes, and repairs).

Real estate can generate cash flow from rental income and provide you and your loved ones with a reliable lifelong income.

What strategies can I use to improve property value?

Renovation

This could include modernising the kitchen and bathrooms, replacing flooring or fixtures, or adding a fresh coat of paint to the walls. By making these types of improvements, you can increase the value of your property as they look more appealing to potential buyers.

Improve Cash Flow

As we explained above, the amount of rent you can generate from a property depends on very similar factors to the property value. You could renovate the property to be able to generate higher rents. Alternatively, you could repurpose the property for another use that generates more rental income. For example, this could be repurposing your long-term rental into a holiday rental.

This is especially true with commercial real estate, such as offices, where occupancy is an important factor in improving property value.

Change the property use

When you buy a property, the property has usually had a specific use, such as acting as a simple family home.

To change things up, you could repurpose it into a holiday rental, an office, a doctor’s office, or a co-living space, to name some examples.

You should consider that your local council often imposes tight restrictions on what property use is possible in a given area. Therefore, you should consult with the local council first on what allowed uses of this property are.

Repurposing the property for another use can be especially relevant if you go into property development. For example, you may want to convert an old industrial property into apartment blocks. However, you will have to consult the local council for approval first.

In any case, make sure you don’t create any unlicensed modifications. This will impact the property value as the council can force you to revert those modifications.

Getting licenses

Conceptualising a building project and getting it accepted by the council can usually take at least half a year. Regional councils are usually understaffed and often don’t prioritise the requests of property developers.

Your building project will require several modifications to adhere to tight guidelines in order to be approved. A carefully thought-out design and approach can reduce your chances of getting the license rejected, you should consider that this will still likely take time.

Once a license is granted, the value of the land instantly increases in value as the council has granted you building rights for this particular area.

Requesting rezoning

When you own a property or land, there could in some cases present an opportunity to rezone industrial sites to residential property areas. However, again, this needs to be approved by the council. As this is an important issue, this is often something to be approved by the mayor themselves.

An approval is often tied to political requests, such as the decision to build social housing or to sanitise the soil from industrial waste.

Wait

Sometimes you can buy land just outside urban areas that is planned to be developed on. This practice is called land banking. It is a process that takes a long time as they are tied to urban changes, which often take decades.

A good example is buying a property near planned metro lines or on the outskirts of urban areas.

There is very little you can do to speed up this process, despite some developers’ best efforts to try and convince regional councils to rezone the land into residential or commercial use.

What strategies can I use to improve cash flow?

Repurpose Properties

For example, you could convert an office building into residential apartments or a warehouse into a retail space. By repurposing a property, you can often increase its value and generate more income.

Appeal to high-value tenants

Appealing to high-value tenants means investing in high-end finishes and amenities or targeting a specific demographic (such as young professionals). By appealing to high-value tenants, you can charge higher rents and generate more income.

Summary – how to earn through real estate investing

In conclusion, there are two core ways to make money through real estate.

Whether you’re interested in investing in property or renovating a property, the general principles remain the same: value appreciation and cash flow.

While investing in real estate can be very profitable, losing your investment is a real risk to consider. Properties come with limitations from both the existing building structure and regulations that you should be aware of.

Should I invest in real estate for my retirement?

Find out how much you can earn from real estate with the Horizon65 app.

How to avoid losing money with real estate investing

Real estate can be a lucrative investment if everything goes to plan. When things don’t turn out as planned, however, investing in real estate can be catastrophic. Below we list some common ways real-estate investments can fail.

Common mistakes those who purchase real estate make

Mistake 1: Overpaying for the property

One of the biggest mistakes that investors make is overpaying for the property. It can be tempting to get caught up in the excitement of a potential investment and pay more than the property is worth.

This can be a big issue when the property’s rental income does not cover the mortgage for the property.

Another issue is that your property investment can absorb too much of your own capital. This means that you may no longer be able to fund the remaining costs to convert the property.

Overpaying for a property puts you in a tough spot as you cannot sell it and recover your money without incurring losses.

Mistake 2: Lack of prior research

Another mistake real estate investors sometimes make is not conducting proper research of the property. This includes researching the area, the zoning, the allowed uses of the property, applicable taxes, structural defects, the property’s history and local market trends. This can lead to you purchasing a property in a declining area or one that has significant issues that weren’t considered in the purchase.

Mistake 3: Not accounting for maintenance and repairs

Another common mistake made is not accounting for the maintenance and repair costs associated with owning a property. These costs can quickly add up and eat away at profits, leaving you with little to no return on your investment.

Mistake 4: Ignoring taxes

There are administrative and fiscal costs when buying and owning a property. These include mandatory notary payments, while you also pay taxes on rents you generate. In Germany, you have to also consider anti-Speculation taxes when you sell a property too quickly. These incur if you sell a property that you have lived in for 3 years, are have been renting out for 10 years.

Mistake 5: Ignoring local market trends

Real estate markets are dynamic and are subject to change. Ignoring local market trends can result in purchasing a property in a market on the decline. This can result in lower rental rates, fewer buyers, and a longer time to sell the property.

Mistake 6: Not having a solid business plan

Investing in real estate without a solid business plan can lead to financial loss. If you want to purchase a property, you need to have a clear plan, including how to finance it, how to manage it, and an idea of the potential sale. Surfacing all the numbers makes it clear what is a good deal and what is a unwise purchase.

Mistake 7: Licensing setbacks

In some cases in the past, property developers have faced particular difficulties from the local council. This can be down to governmental decisions and new legislation, such as new policies for social housing and limits on private developments. As a result, this can hinder the plans of some property developers.

That said, some property developers have bought properties with a specific project in mind that isn’t even allowed in their planned location. It is therefore essential to conduct research of the area and property regulations.

Mistake 8: Delays during construction

A common cause of financial pain when investing in real estate is discovering unknown issues during the construction phase, forcing you to adapt the approved project by the council.

Another common cause for delays are issues with the constructor and subcontractors not delivering on time or delivering poor quality work.

In rare cases, constructors can even go bankrupt during construction. As a result, you will need to find a new one, taking time and money.

You should also be aware of some malicious practices certain constructors, unfortunately, engage in. It isn’t uncommon that constructors have raised financial disputes during work leading to a general pause in construction.

Mistake 9: Poor cost-controls

Constructors are often picked based on the lowest offer and many have adopted a strategy of creating additional problems during the construction.

Fraud can sometimes occur and without experienced oversight, it is easy to go over budget.

Mistake 11: Not paying back bank loans on time

As you can imagine from the above risks, it can be very difficult to keep a real estate development project within set time boundaries. This brings us to the way that most real estate developers lose money.

When you take out loans to finance a project surrounding a property, you must repay the loans on time – and with interest.

However, if you are unable to build and sell the property or are forced to sell it quickly, you might not have the funds to repay the bank.

This is especially common when you use a form of construction finance with high-interest rates and a short payback window – usually 3 years. If you are unable to construct and sell the property within that timeframe, you will default on payments with your bank.

This can lead to foreclosure, where the bank takes possession of the property and sells it to recover the money they are owed. Foreclosure can result in big financial losses as you lose your investment and any ownership you had in the property.

Mistake 12: Lack of buffer

A lot of issues can happen during a project. Developers often start conservatively, but end up investing a lot of capital in the project. They do this in the hopes that their return on investment is high if things go well. However, the same as true for the opposite. If it doesn’t go well, most of the capital will be lost.

This is called concentration risk. This is when you have too invest too much money into one project instead of diversifying.

A good practice when it comes to real estate investing is to take it slowly and keep a large financial buffer so you can recover from setbacks.

Understanding taxes involved with real estate

The main taxes you need to know when investing in real estate are:

Property tax

For example, property taxes can vary widely depending on the location and value of the property. If you fail to account for property taxes in your financial plan, you may not have enough funds to cover the expenses.

Capital gains tax

Capital gains taxes can have a significant impact on the return on investment. If you sell a property for a profit, you are subject to capital gains taxes on the gain. If you don’t account for these taxes, you may not have enough funds to cover the taxes owed, which can eat away at the profit and result in a net loss.

Income taxes

Income taxes can also impact real estate investments. If the property generates rental income, you have to pay income taxes on the income earned. If you don’t properly account for income taxes, this will incur a financial loss.

Mandatory costs

These often make up legal and administrative costs. They include obtaining licenses, architectural fees, submission fees, mandatory checks and additional taxation.

How can I manage these taxes?

To avoid these issues, you must carefully consider the tax implications of your investments and account for them in your financial plan.

How can I lower income taxes?

Germans are known to be more likely to rent, rather than to buy a home outright. However, this isn’t entirely true, as the reason that many Germans tend to rent is to optimise taxes.

When you rent out a property, you can deduct all maintenance costs and property taxes against the income from the rental.

This isn’t possible when you own your own home. However, it is still possible to deduct the mortgage from your income.

How can I lower the capital gains taxes?

Capital gains taxes are exempt if you live in your own home for more than 3 years, or if you’ve rented out a property for more than 10 years. The capital gains taxes here are a way to avoid market speculation

Homeownership in Germany: Advantages and disadvantages

While homeownership in Germany isn’t as prominent as it is in other parts of Europe or the United States, it is still a popular option.

What are they?

Advantages of homeownership in Germany

Your own place to live

When you own a home, you can customise it to your liking, make changes, and invest in improvements that will increase its value. Moreover, owning a home gives you the security of knowing that you have a permanent place to live, without the fear of eviction or rent increases.

Ability to save money

Another significant advantage of homeownership is the opportunity to save money. When you rent, your monthly payments go to your landlord. When you own a home, your monthly payments go toward paying off your own mortgage. This means that over time, you will build equity in your home, which can be a valuable asset.

Disadvantages of owning your own home

Maintenance costs

As a homeowner, you are responsible for maintaining your property and making any necessary repairs. These costs can add up quickly and require a significant investment of time and money.

Homeownership taxes

Property taxes are based on the value of your home – and they can be quite high in some areas.

Tied to one location

If you need to move for work or personal reasons, it can be challenging to sell your home and relocate quickly. This can be particularly challenging in a slow housing market, as it may take months or even years to find a buyer.

How do I finance purchasing a home in Germany?

The most common way to finance a home purchase is through a mortgage. Mortgages are loans that allow you to borrow money to purchase a home, which you then pay back over time with interest.

When applying for a mortgage in Germany, you will need to meet certain requirements, such as having a steady income, a good credit score, and a down payment.

The amount you can borrow will depend on your income, credit score, and the value of the property you’re purchasing.

In addition to mortgages, there are other financing options available, such as home equity loans, personal loans, and government programs that offer assistance to first-time homebuyers.

Homeownership in Germany: Summary

Owning a home in Germany has its advantages and disadvantages, as well as financing options that must be considered.

While owning a home can provide security, a place to live, and the opportunity to build equity, it also comes with the responsibilities of maintenance and property taxes.

It is essential to weigh these factors carefully before deciding whether homeownership is right for you.

Homeownership in Germany

Pros

- Your own place to live

- Ability to save money

Cons

- Maintenance costs

- Homeownership taxes

- Tied to one location

Can I rely on investing in real estate in Germany to fund my retirement?

See how real estate investments fare as a retirement option in the Horizon65 app.

Rental properties – an overview

Investing in rental properties can be an excellent way to build wealth and generate passive income. Not only do rental properties offer several benefits, but they also allow you to diversify your investment portfolios.

What are the benefits of rental properties?

One of the significant benefits of rental properties is that the taxes are paid by the tenant. This means that rental income is taxed at a lower rate than other types of income, such as salary. Additionally, expenses associated with maintaining the property are tax-deductible. This includes repairs, property management fees, and depreciation.

Another benefit of rental properties is that tenants can pay off the mortgage. The rental income can be used to pay down the mortgage on the property, which means that you can build equity in the property without putting any additional money into it. Once the mortgage is paid off, the rental income can be used as a source of passive income.

What risks should you consider when investing in a property?

Investing in rental properties involves some risk, but there are strategies that investors can use to mitigate these.

Tenant screenings

One of the most significant risks is tenant risk, which involves the potential for tenants to cause damage to the property or fail to pay rent. To mitigate this risk, you should conduct thorough tenant screenings and require tenants to provide references and proof of income.

Inspections

Another risk is damage to the property, either from tenants or natural disasters. To mitigate this risk, you can purchase insurance and conduct regular inspections to identify and address any issues before they become significant.

Liability insurance

Investors should also be aware of the risk of damages to third parties, such as injuries that occur on the property. To prevent this, ensure that your property is up to code and that you have adequate liability insurance.

Location

Finally, occupancy risk involves the potential for periods of vacancy, which can impact rental income. The best strategy in general to prevent this is to invest in real estate in a desirable location.

What types of rental properties are there?

We will expand on rental properties in this section. Fundamentally, the three main rental properties you should know are:

Tourist rentals

Tourist rentals are properties that are rented out to holidaymakers or short-term renters. These properties can include holiday homes and apartments located in popular tourist destinations.

Tourist rentals can generate a high income, especially during peak seasons. However, they can also be riskier, as they are subject to fluctuations in the tourism industry.

Room rentals

Room rentals involve renting out individual rooms in a property, such as a house or an apartment. This can be a good option if you want to generate rental income but don’t have enough funds to invest in a whole property. However, room rentals can be riskier as they are subject to turnover and occupancy risk.

Long-term rentals

Long-term rentals are true in name. They are properties that are rented out to long-term renters, such as families or individuals. These properties can include single-family homes, duplexes, and multi-unit apartment buildings. Residential rentals are typically less risky than tourist rentals, as they provide a steady stream of income and have less turnover.

Tourist rentals – an overview

Tourist rentals are typically fully furnished properties that are rented out for short-term stays, usually ranging from a few nights to a couple of weeks. These properties are typically located in tourist destinations such as beach towns, ski resorts, or major cities, and are often marketed through online holiday rental platforms such as Airbnb or Booking.

What are the advantages of owning a tourist rental?

Potential for higher income

Since these properties are rented out on a short-term basis, owners can charge a premium rate compared to long-term rentals.

Additionally, vacation rental platforms often provide an easy way to market the property and manage bookings, which can increase occupancy rates and overall revenue.

Ability to keep using the property

Another benefit of owning a tourist rental is that the owner can still use the property for their own holidays or rent it out to friends and family. This allows the owner to enjoy the property while also generating income from it.

No payment risks

Unlike traditional long-term rentals, tourist rentals typically require guests to pay upfront before their stay. This reduces the risk of payment defaults and ensures that the owner receives payment before the guest arrives.

What are the disadvantages of owning a tourist rental?

Noise complaints

Since tourist rentals are often located in densely populated areas, noise complaints from neighbours can be a common issue. This can result in fines or even legal action, which can be a hassle for the owner.

Damage

Short-term guests can be rough on a property, resulting in damage that may not be covered by insurance. Owners should be prepared to handle repairs and maintenance regularly.

Vacancy risk

Since tourist rentals are often seasonal, there is a higher risk of the property being vacant during off-seasons. This can result in a loss of income and may require the owner to find alternative ways to generate revenue during those periods.

Seasonality

The demand for tourist rentals can be seasonal, which can limit the potential for year-round revenue. Owners should be prepared to adjust pricing and marketing strategies to attract guests during slower periods.

Difficult tenants

While many guests are respectful and responsible, there is always a risk of difficult tenants who may cause damage or violate rental rules. Owners should be prepared to handle these situations professionally and efficiently.

Regulatory limitations

In many places, there are regulations and restrictions on tourist rentals, including licensing requirements and occupancy limits. Owners should be aware of these regulations and ensure compliance to avoid fines and legal issues.

Tourist rentals

Pros

- Potential for higher income

- Ability to keep using the property

- No payment risks

Cons

- Noise complaints

- Damage

- Vacancy risk

- Seasonality

- Difficult tenants

- Regulatory limitations

Room rentals – an overview

As the cost of living continues to rise, more and more people are turning to room rentals as a means of saving money. Investing in room rentals is a great way to make passive income, and it is becoming increasingly popular among real estate investors.

What is a room rental?

Room rentals refer to the process of renting out individual rooms in a property, rather than renting out the entire property. This can be done in various settings, including student housing, co-living spaces, and single-family homes.

It is an excellent way to generate income, especially in densely populated areas where living costs are high.

What are the advantages of owning a room rental?

Diversification

Investing in room rentals allows for greater diversification of rental income streams. With multiple tenants renting different rooms, there is less risk if one tenant decides to leave. Additionally, if one tenant defaults on rent payments, the landlord still has other tenants to generate income from.

Higher income per square meter

The income generated per square meter is often higher when renting out individual rooms, as opposed to renting out the entire property. This is because the cost of living in densely populated areas is high, and people are always searching for affordable housing options.

Lack of rental controls

In most countries, renting out individual rooms is not subject to the same rental controls as renting out an entire property. This gives landlords more flexibility in determining rental prices and creating rental agreements.

Simple eviction (if needed)

If a tenant is unruly and violates the rental agreement or fails to pay rent, it is relatively simple to evict them. This is because the tenant is only renting one room, and the landlord does not have to go through the legal process of evicting an entire household.

What are the disadvantages of owning a room rental?

Higher rotation of tenants

Due to the lower commitment of renting one room, tenants are more likely to move out frequently. This means that landlords have to spend more time and money searching for new tenants and maintaining their properties.

Higher maintenance costs

As there are multiple tenants in one property, the maintenance costs are likely to be higher. Landlords must ensure that the property is always in good condition and that common areas, such as kitchens and bathrooms, are cleaned regularly.

Room rental properties suffer from higher wear and tear because tenants are often young and often have no intention to stay there long-term.

Room rentals

Pros

- Diversification

- Higher income per square meter

- Lack of rental controls

- Simple eviction (if needed)

Cons

- Higher rotation of tenants

- Higher maintenance costs

Long-term rentals – an overview

Long-term rental refers to renting out apartments or properties to tenants for a significant period, typically a year or more. This method of investment involves leasing the entire apartment or property to the tenant, which as always, comes with both benefits and risks.

What are the advantages of owning a long-term rental?

Passive investment income

Once the lease agreement is signed and the tenant moves in, the landlord can sit back and collect rent on a regular basis. This makes it a suitable option for investors who do not have the time or resources to actively manage their properties.

Tenants who take care

Furthermore, tenants who sign long-term leases are more likely to take better care of the property as they see it as their long-term home. This, in turn, reduces the maintenance costs and upkeep for the landlord. Long-term rental also provides a steady stream of income that can help investors to build a stable and predictable cash flow.

What are the disadvantages of owning a long-term rental?

Tenant risk

Tenant risk is one of the primary concerns associated with a long-term rental. Landlords run the risk of tenants defaulting on rent payments or causing damage to the property, which can be costly to repair.

Limited control

Landlords may have limited control over their rental properties, as tenants have the right to occupy the space during the lease period. This means that landlords cannot make changes to the property without the tenant’s permission, which can limit the landlord’s ability to make upgrades and improve the property’s value.

Political risk (rent controls)

In some areas, there may be differences in terms of market pricing and the value of the property. For example, a rent control was ordered by the senate in Berlin, which was subsequently struck down by the German high court as unconstitutional.

Difficult eviction (if needed)

Lastly, eviction is a challenging process for long-term rental landlords. Unlike short-term rental properties, landlords cannot easily evict tenants in long-term rentals. The process of evicting a tenant can be time-consuming and costly, and it can significantly impact the landlord’s cash flow.

Long-term rentals

Pros

- Passive investment income

- Tenants who take care

Cons

- Tenant risk

- Limited control

- Political risk (rent controls)

- Difficult eviction (if needed)

Is investing in real estate the right retirement option for you?

Speak to one of our expert advisors and discover your retirement options.

Questions to ask yourself when choosing a property

When it comes to choosing a property, there are many factors to consider. Buying a property is a big investment, so it’s important to conduct proper due diligence before making a decision.

We’ve put together this checklist that should you ask yourself before investing in a property.

Questions to ask yourself – checklist

Have I done my research?

Before purchasing any property, it’s important to conduct prior research. This involves researching the property’s history, including any past ownership, sales, and legal issues. You should also have a professional inspection done to identify any potential issues with the property.

Can I rent it out?

If you’re considering buying a property as an investment, you’ll want to ensure that it has good rental potential. Look at the current rental rates in the area and assess the demand for rental properties.

What’s the area like?

The area where the property is located is an important factor to consider. Look at factors such as crime rates, access to amenities such as parks and shopping centres, and the overall desirability of the area.

What is proximity to services?

Consider the proximity of the property to essential services such as hospitals, schools, and supermarkets. This can impact the overall livability of the property and its resale value.

Is there public transport nearby?

If you rely on public transportation, consider the property’s proximity to bus stops or train stations. This can impact the overall convenience of the property.

Are there building issues?

Be aware of any building issues with the property, such as water damage, structural issues, or mould. These issues can impact the property’s overall value and require costly repairs.

Is there property historically protected?

If the property is a protected historical property, be aware of any restrictions that may be in place regarding renovations and repairs.

What can I build/develop?

If you plan on making renovations or additions to the property, be aware of any zoning restrictions or building codes that may impact your plans.

What are the tax rates?

Be aware of the various tax rates associated with the property, including property tax rates, purchase taxes, and service taxes.

What are the maintenance costs?

Consider the potential maintenance costs associated with the property, including building maintenance costs, roof repairs, and elevator repairs. These costs can impact the overall profitability of the property.

What are the allowed uses from the council?

Consider the changes you are allowed to make on the property.

Are there structural issues?

Be aware of any potential structural issues with the property, as these can be costly to repair and impact the overall value of the property.

In conclusion, choosing a property involves a lot of research and due diligence. By considering these factors, you can ensure that you make an informed decision and choose a property that meets your needs and financial goals.

How to finance your real estate investment

Investing in real estate is a great way to build long-term wealth and generate passive income.

However, the biggest obstacle for most people looking to invest in real estate is financing.

Real estate is a capital-intensive business, and it requires significant financial resources to get started. If you are looking to purchase real estate, these are the options available to you as well as the risks you need to take into account.

Mortgages – an overview

What is a mortgage?

A mortgage is a type of loan that is used to finance the purchase of a property. Mortgages are the most common form of financing for real estate investments, and they are available from most banks and lending institutions.

In Germany, mortgages are subject to specific requirements and regulations.

What are the mortgage requirements in Germany?

To qualify for a mortgage in Germany, you need to have a minimum down payment of 20% of the property’s value. This means that if you want to buy a property worth €500,000, you need to have a down payment of at least €100,000.

Additionally, your credit score and income will be evaluated to determine your eligibility for the loan.

Bank valuation vs. market valuation

When you apply for a mortgage, the bank will conduct a valuation of the property. The bank valuation is different from the market valuation, which is the value that the property would fetch if it were sold on the open market.

Banks typically use conservative valuation methods to determine the value of the property, which can result in a lower valuation than the market value. This can impact the amount of financing you can obtain for the property.

How can I find out the bank valuation of a property?

Download the Horizon65 app and see how much a property is worth.

Other types of loans available to you

Development loans

Development loans are a type of financing that is used to fund the acquisition, construction, or renovation of a property.

Development loans are typically more expensive than mortgages and are only available to property developers with a track record of successful projects.

Acquisition loans

Acquisition loans are used to finance the purchase of a property. These loans are very expensive and typically have higher interest rates than mortgages. Additionally, they are only available to property developers with a proven track record of successful projects.

If you are a new real estate investor, you may not be able to qualify for an acquisition loan.

Construction loans

Construction loans are used to fund the construction of a new property. These loans are very expensive, with interest rates of around 15% APR. Additionally, they typically have to be repaid in full in a fixed time frame of 1-3 years.

This means that if you are unable to complete the construction of the property within the fixed time frame, you may be at risk of defaulting on the loan.

A common cause of the early demise of real-estate developers.

Renovation Loans

Renovation loans are used to fund the renovation of a property. These loans are available from banks and often guaranteed by the government. They offer very low amounts of financing but as they are guaranteed they have very favourable terms. The clue is in the name: Renovation loans are typically used by those who want to buy a property that needs renovation.

The objective for the government to provide those loans is often to increase the energy efficiency of the house and to meet climate change requirements. They can also be a simple method to create jobs or to improve the housing quality in an area.

Investing in real estate: Conclusion

Real estate investing can provide significant financial benefits but also comes with risks. By understanding the different types of real estate investments, choosing the right property and managing risk, there is nothing stopping you from building a profitable real estate portfolio.

Thinking of investing in real estate for your retirement?

Speak with one of our experts to discuss whether real estate is the right option for you.