Introduction

Inflation is a term becoming all too familiar in the current economic climate. With the cost of living becoming more expensive, the reduction in the purchasing power of your money and worldwide economic uncertainty, it is more important than ever to take action and make sure your money goes as far as it can.

Luckily, help is at hand. We have put together this ultimate guide on how to defend yourself against inflation, and what practical measures you can take to increase your purchasing power. This guide will cover everything you need to know to understand where inflation comes from, how inflation affects your investments, how the central banks reduce inflation and the pros and cons of each investment option.

What is inflation?

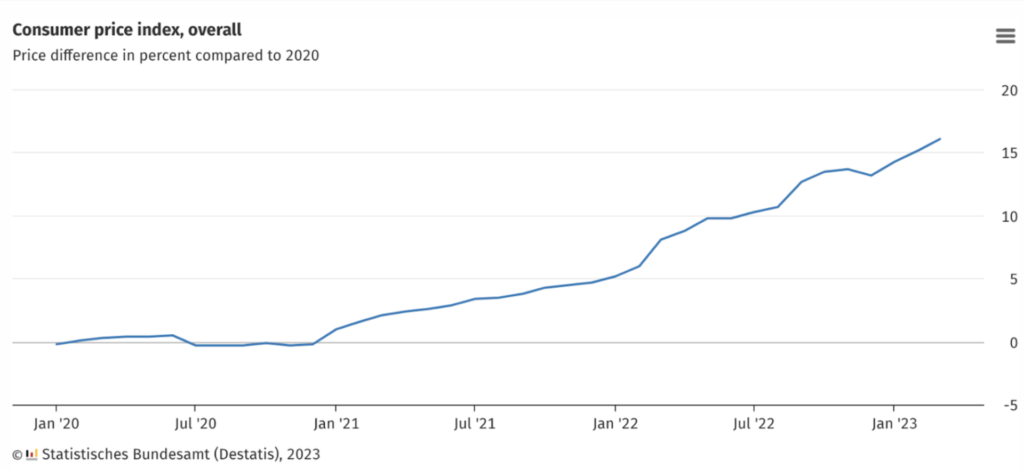

Simply put, inflation is the annual increase in prices for the same goods and services.

It is measured with the consumer price index, which measures a range of broad range of goods people use day-to-day and calculates the price change for those goods from this year compared to last year.

For example, if a cup of coffee costs €3 today, but inflation causes prices to rise by 5% next year, that same cup of coffee will cost €3.15.

Fundamentally, the money you have today is worth less in the future

That’s why it is important to invest that money to maintain its value and not leave it sitting in your bank account.

The effects of inflation over a very long time can be devastating to your savings if you just leave them in the bank. For example, 1 euro in the bank in today’s money will be worth 50 cents in 25 years.

Hoarding cash in your bank account is the absolute worst possible way to save for your future.

Key factors impacting prices

In order to understand inflation and what factors affect inflation, it is important to understand how prices are set in the economy.

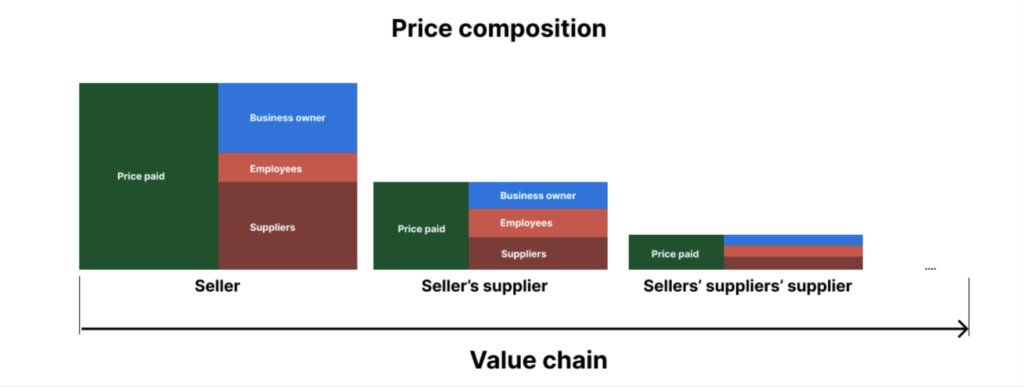

When you pay a business for a good, the money you pay to that business will be used for three things:

- Firstly, the business owner will have to pay their employees

- Secondly, the business owner will pay the suppliers needed to sell you that good.

- Whatever money is left over is left for the business owner themself, i.e. for growth.

For example, let’s assume the business takes up the form of a homemade lemonade stand.

The owner first needs to pay the people who make the lemonade and those who are standing behind the lemonade stand to sell it to you.

Then they need to pay for the lemons used to make the lemonade and any equipment they may need to create the homemade lemonade. These are suppliers.

At the end of the day, whatever they have earned is what is left. This is their margin.

But it doesn’t end there. They paid their supplier for lemons.

This same process repeats with the supplier of the lemons, who have to pay their employees, and their suppliers and retains at the end of the day his margin.

Producing lemons is a more complicated business than making lemonade from lemons so they will rely on suppliers as well.

The entire process across all the suppliers and their suppliers is called the value chain.

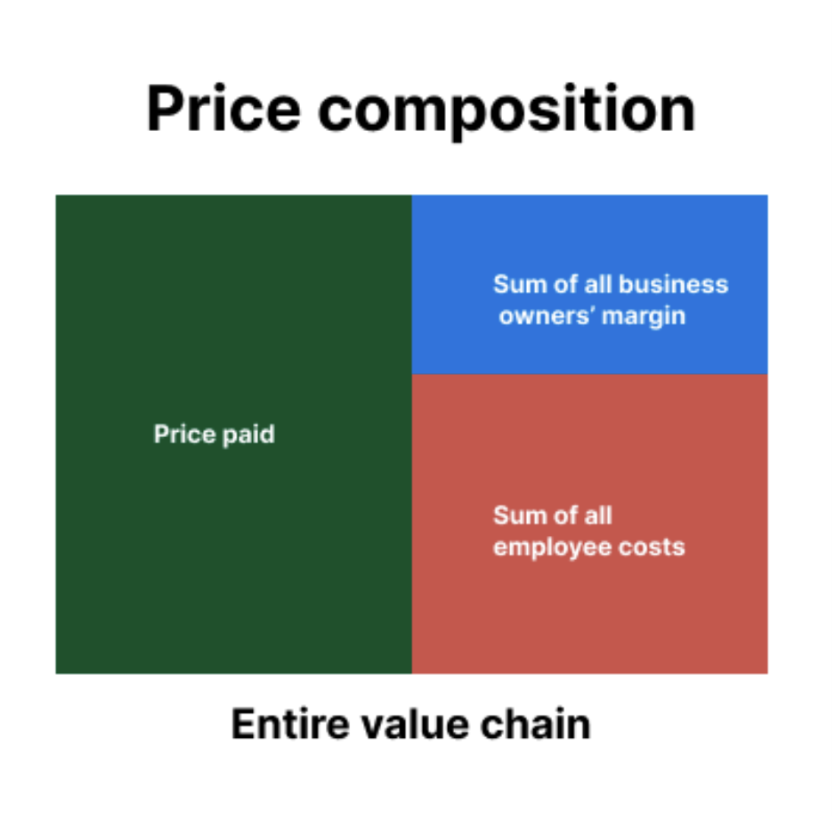

If we add up all the business owners’ margins and all the costs of the employees involved in the value chain, you can see that fundamentally the price is set by two major factors.

- The sum of margins for the business owners along the value chain

- The sum of labour costs of all the employees involved along the value chain

Impact of labour costs on prices

Fundamentally, the lowest price of an item is the sum of all the (fractional) costs of labour that goes into creating this item.

When you pay a business for an item, it will first pay its employees and then its suppliers for the goods or services required. These suppliers in turn do the same, so at the end of the day, all the money of the item first goes towards all the employees involved in the creation of your item.

Labour can be cheaper in different parts of the world. Fundamentally, however, the sum of all the labour costs required to create an item sets the absolute lowest price of an item.

In locations where the required labour is scarce, wages go up. This is something that is can be reflected in the prices of the goods.

Impact of demand on prices

The second main factor is how much of their margin business owners are able to retain after paying their employees and suppliers.

Business owners generally want to set their margins as high as possible. If the situation allows them to do so, this will be something they can take advantage of.

However, if the business owner sets his prices too high, potential clients are more likely to turn to a competitor.

One notable exception would be if the market experiences a surge in demand that it cannot keep up with. This means that business owners have better conditions to charge higher prices more easily.

This is why the business owners’ margins are based on demand.

However, in case of high demand, competing business owners tend make efforts to expand their business quickly and generate more money. This high demand also incites entrepreneurs to create new businesses to compete.

This increases supply, meaning that prices then once again go down. In well-functioning markets (with good legal enforcement, fair competition, lack of corruption, lack of monopolies) high margins are temporary and will erode over time as both innovations and competitors emerge.

What events can affect prices?

Surge in market demand

When a lot of people want to spend money in a certain industry, business owners get to increase margins and hire more staff to meet the demand, leading to higher wages for their employees.

For example, imagine that there is a sudden surge in consumer demand for cars.

If car manufacturers are unable to increase their supply of cars quickly enough to meet this demand, they may choose to raise prices instead.

As a result, the price of cars would increase, and inflation may go up as well.

On the other hand, if many people suddenly stop spending money at once, it can have the opposite effect.

Reduced demand can lead to lower prices, as businesses may lower their margin to attract customers and boost sales.

This can lead to lower inflation or even deflation in the short term.

Reduced demand can also lead to layoffs in the industry, increasing the labour supply and lowering wages.

Governmental spending

Governments can significantly boost spending, leading to a surge in demand for goods and services beyond the existing level. This is particularly true when the spending is from money not received from consumers.

The resulting increase in economic activity increases the need for labour. If labour is scarce in general, wages will go up across the economy, potentially leading to inflation.

Global trade

Opening up new markets can dramatically increase the availability of labour and resources.

For example, the rise of China and their considerably large labour pool in the global economy helped to drive down consumer prices.

However, strict lockdowns in China due to the Covid-19 pandemic greatly reduced the ability of their workforce to participate in the world economy. This reduced production output in China, affecting the value chains of many products.

Supply shocks

Another temporary event that can impact prices is when supplies for critical resources are disrupted quickly and unexpectedly. An example is the Ukraine-Russia war that led to a natural resource supply shock.

Supply shocks are mostly temporary due to provider competition, which helps to normalise the situation. Moreover, businesses dependent on these supplies before the supply shock took place quickly look for alternatives.

What are the negative effects of inflation?

When prices drop or stay the same, there is little incentive to invest money. For example, if a euro in today’s money will buy have the same value years down the line, why would you invest?

The term for when prices decrease or stay the same is called deflation.

It is considered universally bad by economists because it removes the incentive to invest. At the end of the day, why should you put your money at risk at all when not investing it makes you more wealthy over time?

However, deflation isn’t as bad compared to what economists consider the worst-case inflation scenario.

What is the worst-case inflation scenario?

The worst-case inflation scenario is when inflation is expected to continue for long periods of time. This is called the long-term inflation expectation.

This has real negative effects on the economy and financial markets, including reduced consumer and business confidence.

When consumers and businesses expect prices to continue to grow rapidly over time, they are likely to change their spending behaviour.

What are these negative changes in spending behaviour?

- Negative spending behaviour change 1: Spending money while you have it

One negative change is spending the money while you have it mindset. This leads to greatly increased consumer demand and a cycle of price hikes.

- Negative spending behaviour change 2: Stopping investment

If prices rise more than there are available profitable investments in the economy, businesses and people stop investing. This means that there is a tendency to switch to short-term thinking and prioritise their money today, rather than investing for the long term.

What can happen as a result of these negative spending behaviour changes?

When prices are expected to keep increasing substantially every year, the economy can enter a phase of runaway inflation. This is when individuals start to spend more today, pushing up prices, which incentivises even more short-term spending.

This can lead to a vicious cycle where people begin to expect even higher inflation and rush to spend their money quickly, further driving up prices.

Runaway inflation can have severe economic consequences, such as currency collapses, a sharp decline in economic output and high levels of unemployment.

How do the central banks play a role to prevent this?

The central banks’ goals are to fight inflation at all costs, yet still maintain a small amount of inflation to avoid the deflation scenario.

Generally, achieving a 2% inflation is a common goal set out among most central banks.

Why 2%?

2% is an amount that isn’t obviously noticeable in day-to-day spending but is nevertheless significant enough to incentivise investing.

Why do central banks increase interest rates to fight inflation?

To understand the role of central banks with regard to inflation, it’s important to understand the relationship between central banks and the government.

Central banks are created as a safeguard for the economy. Apart from acting as a failsafe for failing banks, they are also tasked with keeping inflation low.

Central banks in democratic countries are an independent body from the government in democratic societies.

This is because they have to be able to make highly unpopular decisions for the benefit of society, something which would be very difficult for a government to stay in power. An example of this is the Volcker shock.

This is when the federal reserve in the US raised the interest rate to 20% in 1981, causing a heavy recession in the economy. However unpopular this measure, it did in fact help to put an end to the high inflation era of the 1970s.

What can a central bank do to keep inflation low?

Central banks can do several things. However, increasing interest rates is seen as the most important decision a central bank can make.

What is the central bank interest rate?

The interest rate set by the central bank represents the amount of money given to standard banks as a deposit. This interest rate sets the standard for the interest rates that the banks offer on new loans.

The result of raising this standard is that costs of borrowing go up and with that, the ability of businesses to invest in projects go down.

An example of this is that when mortgages go up, the availability for individuals to purchase properties goes down in tandem.

Effectively, the interest rate is a tool to regulate demand.

When loans become more expensive due to higher interest, businesses tend to borrow less money from banks. This means that fewer investment projects are likely to be pursued, resulting in fewer demands for services and goods.

This decreased demand is in turn likely to incentivise business owners to lower their margins. This means they might have to lay off some of their employees to compensate.

Why would this be unpopular if these policies were made by the government?

Generally, politicians don’t tend to get re-elected when voters lose their jobs. Moreover, it is hard for central banks to predict when exactly they should stop raising interest rates. In fact, actions taken by central banks to lower inflation in the past have occasionally, overshot their target and in fact put the economy into recession.

Government lending also becomes more expensive

Governments’ budgets become harder to maintain and the increased cost of their debt may require them to reduce popular programs such as social spending.

People’s wealth is directly affected as valuations decline

Raising interest rates has a disproportionate impact on the valuations of existing investments, resulting in lower returns on investment. This would be very difficult for politicians to justify to voters.

How does raising interest rates decrease inflation?

Raising interest rates increases borrowing costs for companies and this slows down economic activity as less projects get the needed finance to start.

The sum of all the spending in the economy (aggregate demand) goes down and the competition for the remaining business goes up.

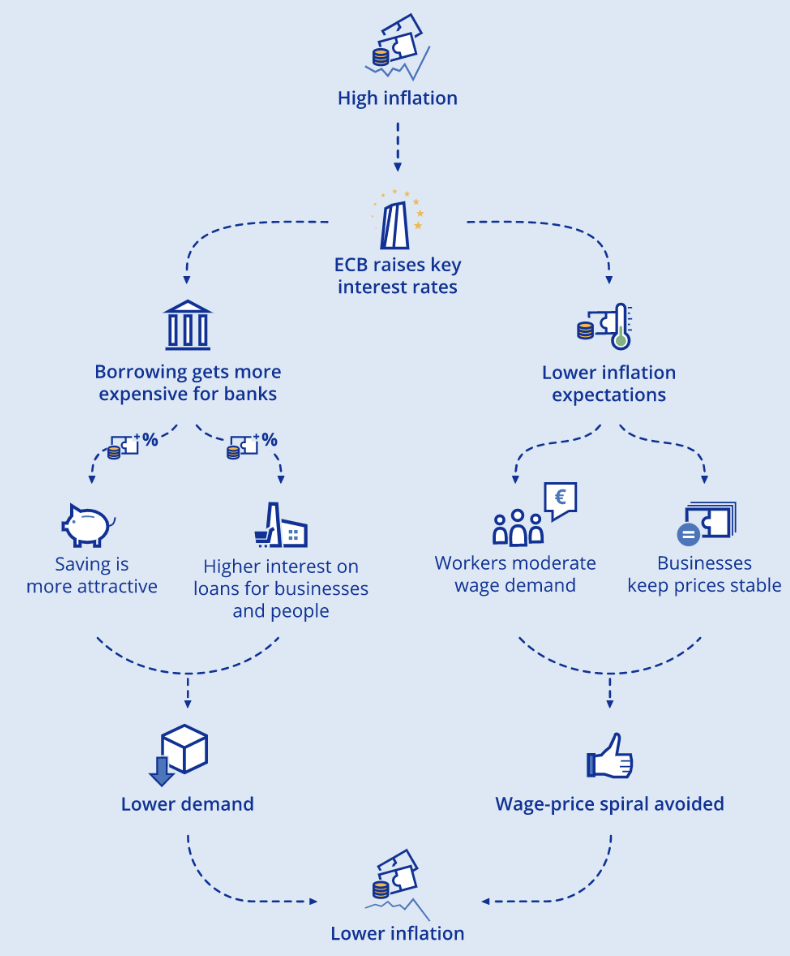

This graphic from the ECB sums it up quite nicely:

How inflation affects investments

What is the real return?

Real return is the actual return on investment you receive. It is subject to inflation, meaning real return can fluctuate.

What does an example of this look like?

Let’s say you invest €10 (the cost of a BigMac meal) into BananaRepublic government bonds, bonds that pay 50% interest. This means you will have €15 next year.

However, prices doubled since last year and a Big Mac menu now costs €20.

In real terms, you are able to afford a Big Mac menu today with €10 and not one year from now when it costs €20.

Your return was 50% on the money you invested into the bonds, but your ability to buy a Big Mac meal decreased by 25%. This is called the real return. Saving your cash in your bank account has tended to result in a negative real return of around -1.5%. However, as of 2023, negative real returns have even reached 8.3%.

What is the smartest investment for my situation?

Find out your most suitable investment options with an Horizon65 investment advisor.

For a broader take on inflation, let’s look at how inflation affects investments in general.

The impact of inflation on valuations

The whole point of investing is to gain a positive real return on your investment.

Investments that have a positive real return are often referred to as an inflation hedge. This is an investment that performs well, regardless of how high inflation gets.

Now, transferring money to purchase an asset is the simple part of investing.

The more difficult part is getting your money back, hopefully with a return on that investment.

There are two main ways you can get your money back:

Investments are paid back over time with regular payments (e.g. rent, dividends).

Investments go up in value and are paid back when you sell the asset (e.g. valuations)

Of these methods, cash-flow-based repayment is seen as the most secure. It does not rely on the market value of your investment. Rather, it relies on the ability of the investment to generate profit instead.

For the second category though, we have to look at valuations and how they work.

Cash-flow based valuations

Cash-flow valuation is a method of estimating the value of an investment asset based on the cash it is expected to generate.

However, apart from getting back the original investment, there are two other factors that go into setting the price of this asset.

Firstly, there is the expected return that the investor is expecting to receive.

This is set by market demand for this type of asset. The asset seller is incentivised to sell at a higher sale price, while the asset buyer wants a higher return on investment.

Let’s assume the going market rate for this type of asset is 5%.

Let’s look at simple cashflow valuations with an investment of €100 that pays itself back in 10 years, while the investment stops paying you back after 10 years.

Mathematically here, €100 goes in, and €100 eur comes back.

However, say the investor who wants to make a 5% return on their investment is only willing to €87 eur for this when there is no inflation.

If the investor expects that the inflation will be 5% for the next 10 years (long-term inflation expectation) then they are only willing to pay even less.

This is because in addition to their returns, they will also want to make sure they are not losing the money they have in real economic terms.

In that case, they are only willing to pay €71 for this investment.

This is how inflation affects cash-flow-based valuations.

Furthermore, this example assumes that the cashflow from the investment itself isn’t affected by investment, which isn’t true in most cases.

With real-estate investments, one can often increase the rent based on inflation. With companies, the profit typically decreases when business costs increase.

Market-based valuations

The value of an investment is ultimately determined by the price that willing buyers in the market are willing to pay for it.

This typically means that willing buyers have a minimum return expectation for this certain type of investment, while taking risk into account (reliability of returns).

While stocks have historically offered higher average returns than bonds, bonds are generally considered a safer investment with more predictable returns.

That said, market valuations are not always numbers-based.

Market valuations are fundamentally driven by supply and demand. If demand goes up, so do valuations.

Market demand can be emotionally driven in some cases, such as a homebuyer who pays above the going market rate for a property they particularly like.

Another common factor is the urge of the investor to invest now, rather than later due to a fear of missing out.

FOMO, or the fear of missing out, is a prevalent emotion among investors in both the cryptocurrency and stock markets. Investors often feel compelled to buy assets at current prices in the hopes of profiting from future price increases, leading them to hold onto their investments in the hopes of selling them at a higher price later.

Market-based valuations are typically based on rational analysis of numerical data, but it’s important to recognise that emotions can also play a role in determining the price buyers are willing to pay.

Production cost-based valuations

When manufacturers are able to produce goods such as cars or commodities like iron, copper, or oil under favourable conditions, the supply of the good is often not limited.

As a result, the price of the asset is primarily determined by the production cost.

In situations where there are many potential producers competing in the market, profit margins can be significantly reduced, sometimes to as little as 5%.

In such cases, the market price of the good can be calculated as the aggregated labour costs, plus this minimal margin of 5%.

Impact of inflation on valuations

Inflation can impact cash-flow-based valuations by raising the investors’ expectations for returns and potentially reducing the profitability of an investment.

The more immediate these cash flows are, the less the valuation will be affected. However, higher inflation tends to lower the valuation of these investments. Should inflation go down, however, these investments should be able to bounce back.

Growth stocks such as Uber, where revenue is more of a promise than a reality are hard-hit if an investor approaches the stock price as a cashflow-based valuation.

What about production-based valuations?

Production-based valuations are particularly responsive to inflation as valuation increases in line with the production cost.

For most investments, the valuation is primarily determined by the market. The demand for an investment may be based on the belief that its value will increase in the future, as with cryptocurrencies, or may be driven by increased spending in the economy, such as when governments invest heavily in infrastructure.

Therefore, when planning to defend your wealth against inflation, it’s important to avoid solely market-based investments as the outcome has often proved to be uncertain.

How much will your investments be worth in the future?

We at Horizon65 created a mobile app to let you find out exactly that.

Overview of potential investments and likely reaction to inflation pressure

While we don’t know for sure how investments and their valuations will react to inflation, we can look at the impact of inflation on each of them.

Commodities

Commodities are basic goods and raw materials that can be bought, sold, or exchanged in financial markets. They are often used as inputs in the production of various goods or services.

Commodities cover a very broad range of products, such as:

- Agricultural produce (grain, livestock, diary, forestry)

- Natural resources used for energy production (oil, gas, coal)

- Environmental allowances, metals (precious metals, industrial metals)

- Chemicals (plastics, industrial gases, fertilisers)

Investing in commodities usually takes the form of buying and storing them, or buying a delivery of the goods in the future.

Commodity prices are strongly correlated to economic activity and demand.

Precious metals

Precious metals are often touted as a means of protecting against inflation.

However, the significant changes in the value of these metals are largely driven by investors seeking protection from inflation or economic crises.

Therefore, when reading about inflation and the prices of precious metals, it’s worth noting that these prices may already be high due to market expectations, rather than reflecting the actual impact of inflation.

Industrial metals

Industrial metals are consumed by their buyers shortly after purchase. Their valuation is mostly based on the production cost of the metal.

For the past 40 years, Industrial metals have proven to be the most reliable inflation hedge.

Real estate

Real estate is also considered to be a reliable hedge against inflation. Historically the prices of real estate have been able to adjust in line with inflation.

This is due to several factors

- Difficulty of new builds

The high cost of building new real estate and the large amount of labour required to do so tend to restrict the supply of properties for sale.

- Population increase

More people means more need for housing.

- Rental increases

Rents tend to be indexed by inflation, which allows real estate investors to afford the increased mortgages.

The downside of this is that properties can become less accessible to purchase when mortgages become more expensive. This is down to central banks increasing interest rates.

It is with considering real-estate linked stocks that invest in rental properties such as REITS (Real Estate Investment Trusts).

Stocks

Stock ownership, such as public stocks or privately traded stocks (private equity), can also be affected by inflation.

During times of inflation, the costs of raw materials, labour, and other inputs tend to increase. This can negatively impact a company’s margins and decrease the ability of the business to keep investing in competitive advantages.

Additionally, rising inflation can lead to higher interest rates, which can decrease demand for the goods and services the company offers to its clients.

One advantage of stocks is that their prices respond quickly to investors’ expectations, meaning that companies that may be negatively impacted by inflation are often already priced in, and may have already declined in value.

The question when investing in stocks is then, which stocks rise in value when central banks have engineered an end to inflation.

Which stocks can best survive long-term inflation?

As of 2023, the market does not anticipate that inflation will be a long-term issue because central banks are actively increasing interest rates to combat it.

However, if you have a different view and believe that inflation will persist, this could present an opportunity to invest in companies that have the ability to survive and potentially even thrive in a high-inflation environment.

Here are two categories that are likely to do well in times of high inflation:

High-margin profitable companies

The ability of a company to charge prices that exceed its service costs is a strong indicator of the perceived value of its services by its clients.

A high-profit margin can help companies deal with inflation because it provides them with a cushion to absorb the impact of price increases in the broader economy.

Often, companies with highly valued services are able to increase their prices without losing customers. This is because their clients are willing to pay more for the perceived value of the service.

If you believe that inflation is here for the long term, high-margin stock companies are a good choice to combat inflation.

Companies with high-profit margins have more financial cushion to handle unexpected expenses or changes in interest rates.

This means they are less likely to rely on taking on debt to finance their operations or expansion plans. Therefore, changes in central bank interest rates are less likely to affect their financial stability.

Pros and cons

Pros

- Scenario is not priced into the market

- Good pricing power to remain profitable

- Ability to absorb increased costs

- Less reliant on debt

Cons

- Vulnerable to innovation and new competitors

- No guarantee the market will reward them for their ability to survive with higher stock prices

Residential real-estate investment trusts (REITS)

Real-estate investment trusts are the largest landowners in the world. They are deemed to be a cost-efficient way to invest in real estate.

The adoption of remote work is causing significant changes in commercial real estate, but residential real estate remains a reliable option for protecting against inflation.

Why is this?

Residential rents tend to increase year on year in line with inflation, while the stocks themselves generate dividends.

That said, REITs remain vulnerable to central bank interest rates as they rely heavily on debt to invest in real estate.

If the central bank raises interest rates that exceed inflation rates, their profitability will likely erode.

Pros and cons

Pros

- Residential real-estate demand is rising

- Income increases directly with inflation

- Valuation of stocks is cashflow-based and more reliable

- Price will adjust even during the period high inflation period

Cons

- Reliant on debt

- Profitability can be eroded by aggressive central bank actions

Stocks that would benefit if inflation quickly passes

This investment strategy involves investing in assets that have recently decreased in value, with the assumption that they will eventually regain their value once inflation is brought under control.

This depends on the central bank engineering an end to inflation.

Technology growth companies

Stocks in the technology sector took a beating when inflation increased.

This is because the emphasis of these stocks is based on growth, rather than profitable revenue.

However, it’s important to note that such stocks tend to revert back to pre-inflation levels once inflation subsides.

If you’d rather put your money elsewhere, it might be worth considering investing in profitable-based technology stocks, rather than growth-based stocks.

Pros and cons

Pros

- Price is unlikely to drop further than it already has

- Increased long-term revenue of such stocks

Cons

- They may not survive a long-term inflation environment

- Price will only adjust after the high inflation environment has ended

Bonds

Debt instruments, such as bonds, tend to be negatively affected by inflation. This is because inflation erodes the purchasing power of the payments the bondholder receives.

If you purchased bonds before central banks raised interest rates, you’re likely aware that when rates increase, bond prices tend to decrease.

However, when the central bank increases rates, newly issued bonds become more attractive to investors.

As of 2023, inflation still remains higher than the central bank interest rates, resulting in a negative real return on bonds.

Pros and cons

Pros

- Safe investment

Cons

- Central bank interest rates are not high enough to use this as an inflation hedge

Money deposits (such as a savings account)

Deposits, such as savings accounts or certificates of deposit, tend to be quickly eroded by inflation.

While increases in interest rates can reduce the damage of inflation, they typically aren’t enough to preserve your wealth.

Pros and cons

Pros

- Safe investment

Cons

- Central bank interest rates are not high enough to use this as an inflation hedge

Crypto

Crypto is a special case. Cryptocurrencies lack productive use in the real economy and their purchase and sale are not based on company demand.

The production of crypto tokens is fixed, which creates supply constraints, yet there remain no real demand drivers.

This means crypto has no production cost valuation.

Likewise, crypto doesn’t generate cashflow either.

This means that the value of crypto is entirely based on market demand, with the vast majority of buyers hoping that crypto will increase in value over time.

As it is an entirely speculative asset, there is no meaningful way to predict how crypto prices will evolve in response to inflation.

Pros and cons

Pros

- N/A

Cons

- Impossible to predict price evolution as it is not based on rational factors

- Not tied to the real economy

Conclusion

Depending on your expectations of the future, there are ultimately only four real options available to you to defend against inflation

- Industrial metals

- Profitable high-margin technology stocks

- Residential REITs

- Rental properties

How can you shield your investment against inflation specifically? Book a free consultation with an investment advisor at Horizon65 to discuss your situation in depth.