According to the German Pension Insurance Fund, male pensioners in the old federal states received an average monthly pension of 1,179 euros in 2021. In the new federal states, the figure was 1,249 euros a month.

The figures are significantly lower for women, receiving an average pension of 741 euros in the old federal states compared to 1,065 euros in the new federal states. These gross pension amounts are based on the statistical mean values of payments as of Dec. 31, 2020.

Net Pension

However, the net pension is lower since health and long-term care insurance contributions are also deducted. A gross pension of 1,100 euros, the net pension is between 950 and 1,000 euros. Pensioners pay 7.3% of the gross pension for health insurance and 3.05% for long-term care insurance.

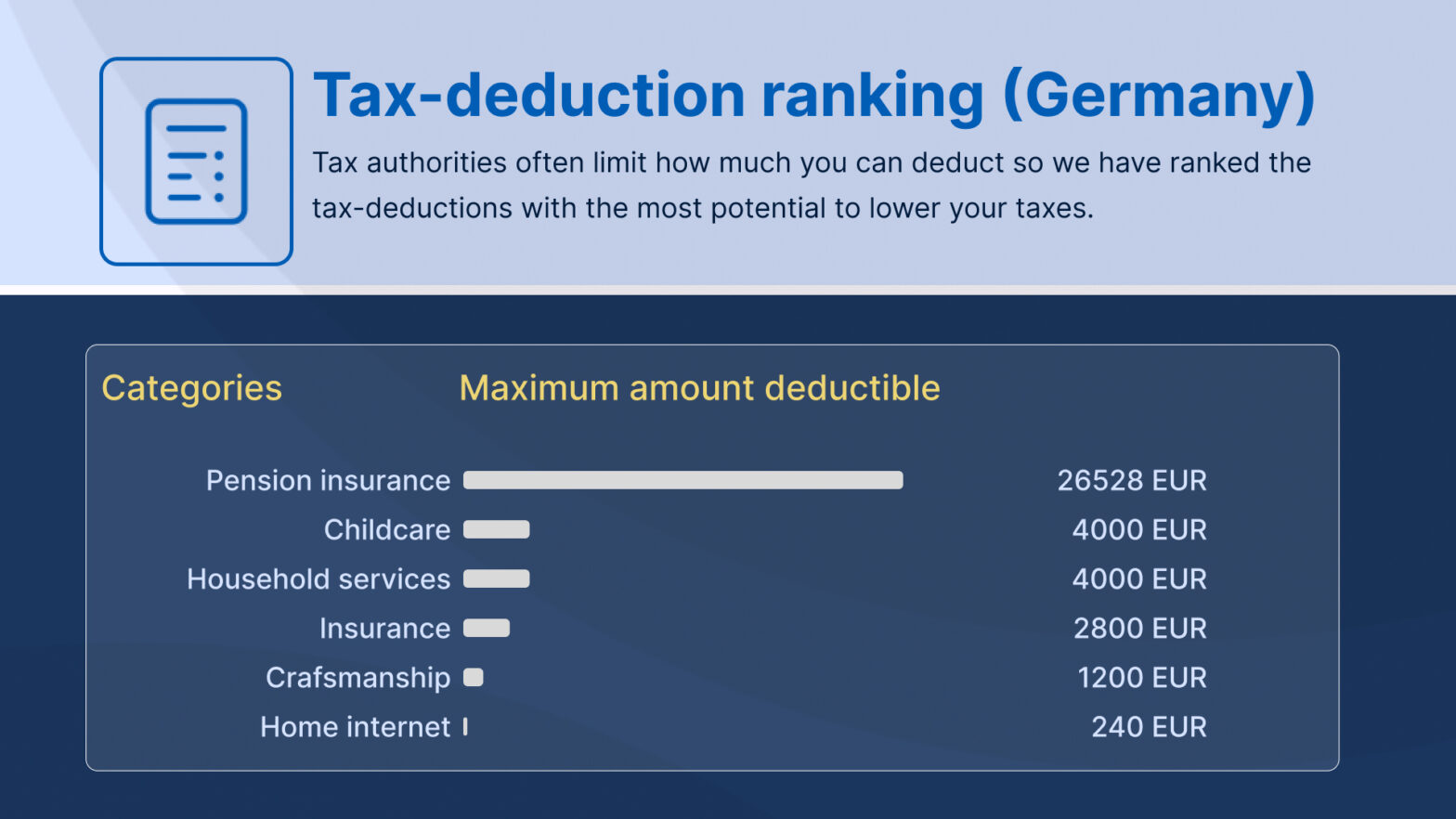

Taxes are payable on all additional income if their pension is above the annual basic tax-free amount of 9,984 euros (as of 2022).

Standard Pensioner (Benchmark Pensioner)

On July 1, 2021, the standard pension (also known as the corner pension) in the old federal states was 1,538.55 euros gross, whereas, in the new federal states, a standard gross pension was 1,506.15 euros.

But what is meant by the standard pension? It is a figure used to calculate the normal pension level. The amount shows what will be received based on a history of working at least 45 years with an average income.

Calculate pension level

The German pension calculator helps calculate your statutory pension insurance income. The German pension insurance website will calculate the pension’s start date and expected amount. It is a free pension calculator that requires 4 steps:

- Calculate the pension start date

- Confirm the results of when the pension will start

- Calculate the pension amount

- Confirm the results of the pension amount

Details can be found at www.deutsche-rentenversicherung.de.

Pension Plan Calculator

Information is provided annually from German pension insurance to confirm your expected pension. Alternatively, you can calculate the amount yourself using the German pension calculator.

It can be surprising how low the monthly amount will be, with the average gross pension for men under 1300 euros and women under 1100 euros per month.

Although pensions increase yearly, the increase is largely neutralized by inflation.

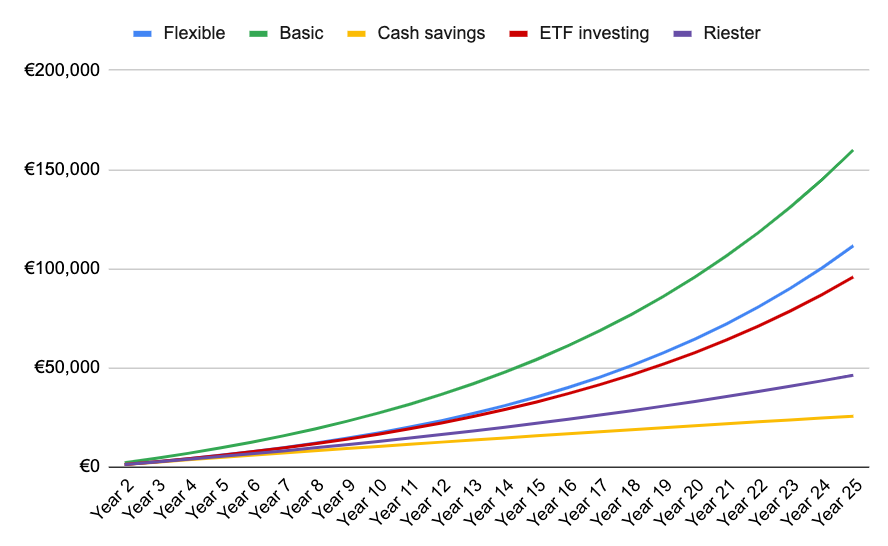

Making private pension provision so critical. Making private pension provisions so critical. The pension plan calculator makes it easy to calculate how much you need from your private pension to receive an amount X per month.

Here’s An Example:

If you pay into a long-term investment with a realistic 6% return (e.g., stock or ETF savings plan) every month for 30 years, you will save 97,953.13 euros, based on a 3% inflation rate. Paid over 20 years, this gives a monthly private pension of 692.62 euros.

However, you prefer to air on the side of caution, enter 4%t into the calculator. You would still have saved 68,760.17 euros after 30 years, giving a private monthly pension of 414.04 euros – again for 20 years (inflation: 3%). On the same terms, if you save 150 euros per month, you could save 103,140.18 euros or a private monthly pension of 621.06 euros.

Various free pension calculators online will give you all the information to accurately plan your retirement.

Self-Employed Pension Calculator

Self-employed persons are not currently subject to compulsory pension insurance in Germany. However, legally they can voluntarily pay into the German pension insurance or make private provisions for their old age.

However, it may soon be compulsory to contribute to their pensions. According to a German Federal Ministry of Labor study, solo self-employed workers could soon be legally forced to make compulsory contributions to protect themselves from poverty in old age. . The study offers two options: contributions to the statutory pension scheme or a “private” basic pension in the form of a Rürup life insurance policy.

The Federal Statistical Office advises around 3.5 million self-employed in Germany in 2021, with 2 million being solo self-employed, i.e. small business owners without employees. The study shows that 40% cannot save for retirement due to their income levels. But What Would Be A Better Solution?

The same legal and tax conditions apply to both forms of savings. The only difference is that the basic pension is with a private insurer, and, unlike the statutory pension, capital is also built up, along with interest.

Paying Into A German Pension Insurance

The considerations of the Ministry of Labor are not (yet) law. However, here is how “compulsory insurance” for solo self-employed can be favorable.

The best way to show this is with an example:

A 32-year-old pays into the state pension fund for 35 years and retires at 67, the standard retirement age.

The goal is to get to the corresponding basic pension of 800 euros at 67 through contributions over 35 years.

And this is the formula to calculate it:

Gross salary per month /100 x years of work = pension.

2,300 euros/100 x 35 = 800 euros

To confirm, a self-employed person earning 2,300 euros gross and contributing to the German pension insurance fund will receive a pension of 800 euros after 35 years. The monthly contribution of 2,300 euros gross is 18.7% or 430 euros.

Paying Into A Rürup Life Insurance Policy

Now to compare life insurance with a private policy, paying 800 euros pension after 35 years of contributions.

Good insurance companies offer a pension at the age of 67 of around 135 euros per month from 35 years, classic pension insurance policies with a monthly premium of 100 euros. These classic policies invest in safe but low-yielding government bonds or mortgages with good credit ratings.

For a pension of 800 euros, 592 euros must be saved monthly, as a simple rule of three calculation shows, costing over 160 euros more per month than German pension insurance.

In both cases, the pension is guaranteed by law.

While there are still no compulsory contributions for the self-employed required, these examples show how important old-age provisions are for this group. The pension calculator for the self-employed is the same as the pension plan calculator (section above). With its help, you know exactly how much to invest monthly and the monthly amount you will be paid over any period. This gives you an accurate overview of your financial situation in retirement.