Introduction

Navigating the complex world of taxes can be daunting, especially in a country like Germany, known for its meticulous tax system where every German government commits to simplifying the tax code, only to abandon the effort silently. Whether you’re a long-term resident or an expatriate, understanding tax deductions can significantly improve your finances.

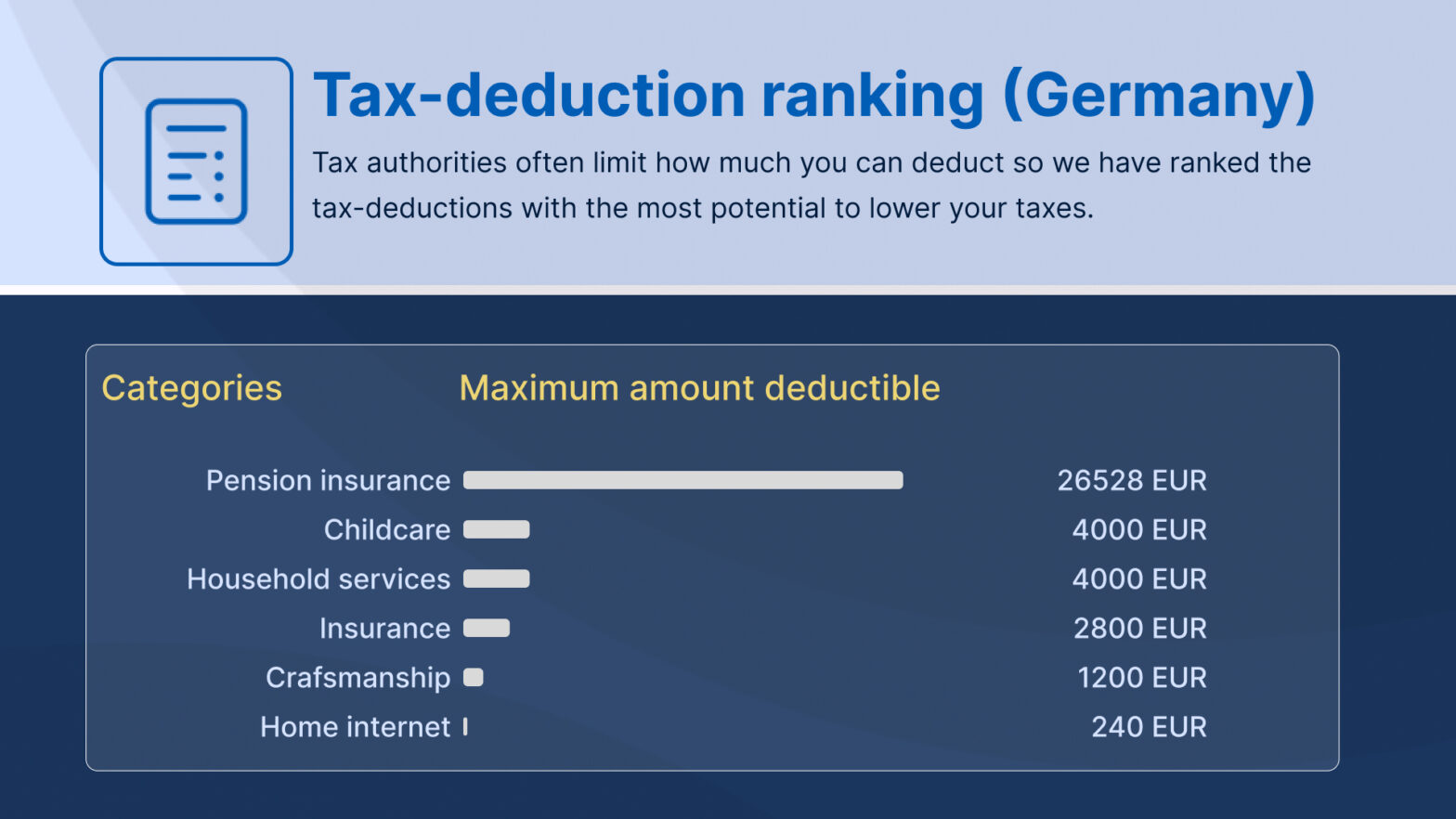

This article will walk you through the top 5 tax deductions in Germany for 2024 that have the most potential to save you money.

What is a tax-deduction?

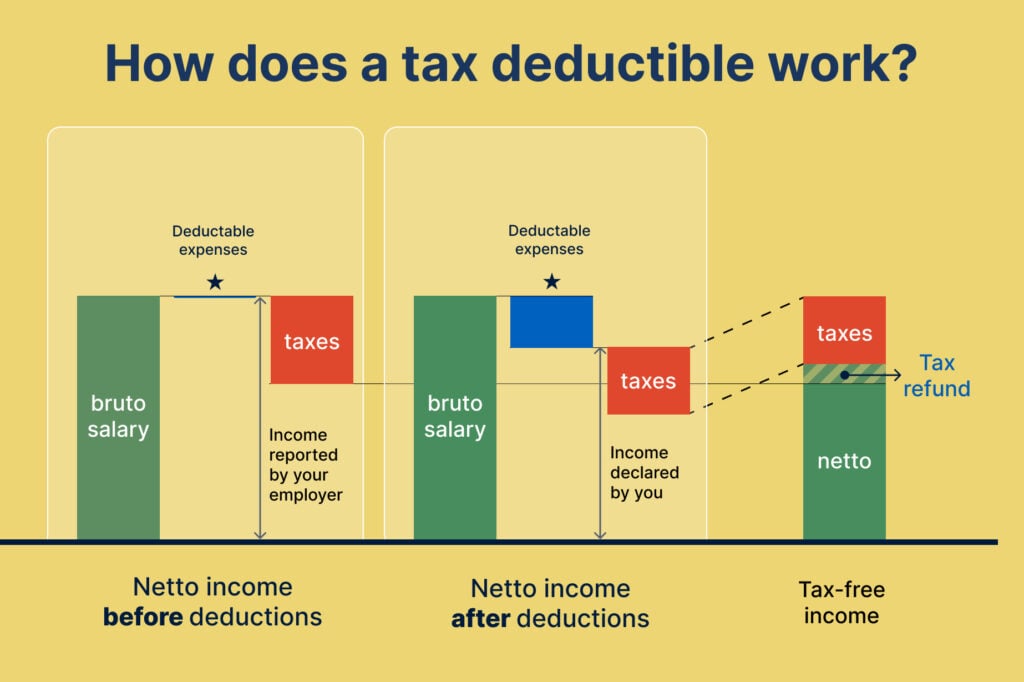

In essence, a tax-deduction allows you to lower your taxable income towards the Finanzamt. This can result in a tax refund as your employer has communicated to the Finanzamt your income already and has already wired the tax you have to pay on that income to the Finanzamt.

However, if you make a tax declaration and tell the Finanzamt that you have less income than your employer communicated, they will refund you the difference.

Essentially, you can claim back a part of your brutto income but the Finanzamt has very strict rules for what qualifies as a tax-deductible and what not.

1. Pension savings contributions (Altersvorsorge)

Like most modern countries, Germany allows its citizens to save for their old-age through a tax-deferral scheme. In Germany, the scheme is particularly generous and allows you to deduct up to 26,528 eur from your taxable income if you file as an individual and 51,278 eur if you file as a couple.

Important to know is that your employer is already required to contribute money towards your retirement and you can find this amount on your payslip. This amount is already counted towards the limit.

Can I deduct ETF savings plans?

It is possible to save in ETF savings plans through a private pension plan but most ETF savings plan providers on the market do not qualify for this tax deduction.

That said, if you are already saving for your retirement in this way then it is definitely a great idea to move those savings to a private pension plan that invests in the same ETFs but does qualify.

Do note that not all private pension plans qualify either and it’s best to use our comparison portal to find the right provider or to book a consultation with our experts.

ETF-based private pensions plans?

Find out which providers allow you to invest in ETFs in our comparison portal.

How do I declare this?

The category to declare this is called Altersvorsorgebeitrage, but since only BaFin regulated entities can offer private pension plans with tax advantages they are also reporting this already directly to the tax authorities.

Example

Stefan has an income of 5000 eur/month and his employer already contributed 11,600 eur per year in mandatory state pension contributions. That means Stefan still has 14,928 eur he can deduct from his income.

Retirement savings: What is included?

Pros

- Mandatory state pension contribution from the employer

- Mandatory state pension contribution from the employer

- Contributions to a private pension (rürup)

- Contributions to a profession-linked pension fund

- ETF-based private pension plans (insurance-based)

- Classical Pension insurances

Cons

- ETF savings plans

- Stocks

- Flexible private pension plans

- Riester plans

If you want to start saving for your retirement but don’t know where to start then definitely check out our app or book an initial free consultation with one of our experts.

2. Childcare costs

Being a parent can be though financially and the German state provides significant help for families. Not only do they provide ‘Kindergeld’ to help out with family expenses but also childcare costs can be deducted at a rate of 2/3th of the expense.

The expenses must be made exclusively to care for the child and therefore does not include costs incurred on family outings or birthday parties.

You can deduct 4000 eur every year of childcare costs.

How to declare?

Childcare costs have to be declared in a tax declaration, you also need to preserve evidence for the tax authorities that such services have taken place in case they choose to inspect you.

Example

Stefan has costs of 3000 eur per year for childcare, he can deduct 2/3th of those costs. Stefan can thus deduct 2000 eur from his taxable income.

Childcare costs: What is included?

Pros

- Kindergarten

- Daycare

- After-school care

- Creche

- Nanny

Cons

- School fees

- Extracurricular activities (e.g. piano lessons)

3. Household services

You can deduct up to 4000 eur/year of household services such as gardening, cleaning, ironing and other activities that are often done in “black”. This tax deduction was created to combat the black market by incentivizing you to employ legal labour and also to promote the local economy.

You can deduct 20% of the qualified expenses under this scheme up to 4000 eur maximum but you need to get an invoice for the service from a registered company or professional.

The payment must be made by bank transfer!

How to declare?

These expenses have to be declared in a tax declaration under the category “Haushaltsnahe Dienstleistungen”

Example

Stefan has a maid that helps twice a week and does so legally and he also has care for his father who lives with him from a care provider. In total he has 5000 eur in expenses each year of which he can deduct 20% which is 1000 eur.

Household services: What is included?

Pros

- Cleaning services within the home

- Garden maintenance

- Winter services (snow removal,..)

- Laundry services provided in the home

- Care services for dependents in the home

Cons

- Cost of material

- Services delivered outside the home (drycleaner, ironing, …)

4. Insurance

Unlike other western countries, Germany provides very basic governmental insurances and instead relies on the individuals’ responsibility to seek cover for the most common scenarios.

That said, they allow employees to deduct up to 1900 euros for health and nursing care insurance and up to 2800 euros if you are self-employed.

If you still have budget after health and nursing care insurance then you can also deduct other insurances such as income protection (inability to work) or accident insurance.

How to declare?

You have to declare these expenses under the category of “Sonderausgaben” when you do a tax declaration.

Example

Stefan pays as an employee 352 eur per month in healthcare insurance which exceeds the 1800 allowance so he can deduct the maximum.

Insurances: What is included?

Pros

- Healthcare insurance

- Nursing care insurance

- Income protection

- Liability insurance

- Accident insurance

Cons

- Tax-deductable pension insurances

- Other insurances

Which private health insurance provider is best for me?

Compare various plans offered by private providers based on your needs.

5. Craftsmanship

The last big deduction available to you in Germany is for work done in your home by a registered craftsman. The goal of this tax-deduction is also to legalize labour that is typically done in the black market and up to 1200 eur per year can be deducted.

However, only 20% of the expense can be deducted and the work has to be done in your

20% of works to your primary home can be deducted if the work is done by a registered professional, invoiced and then paid with a wire transfer.

How to declare?

You have to declare this work under the category of “Handwerkleistungen”

Example

You spend 8000 eur on renovations in the house with a registered tradesman which means 1600 eur could be deducted, however the maximum allowed is 1200 eur.

Craftsmanship: What is included?

Pros

- 20% of the labour cost

- Travel costs incurred for the work

- Works paid by wire transfer

- Works done by a registered professional

Cons

- Material costs

- Cannot be combined with publicly funded works (KfW loan)

- Works not done in the primary residence

- Work done in a newly built home

What about all the other tax-deductions?

There are many more tax-deductions available to you in Germany but these are the biggest ones, if you enjoyed this article please share it with your friends.

Want to know all the other tax-deductions in Germany?