Receive an email from us with a download link to open on your mobile phone.

By clicking the button you accept our privacy policy.

Source: EU Report for pension adequacy

An additional 2 Trillion Euro per year need to be saved in the EU to avoid widespread poverty. This is an issue that affects everyone, yet remains largely unadressed.

When Horizon65, Nicolas Overloop, investigated this issue, he determined that while most people were doing something against this, they weren’t saving enough.

What did he find out?

Those who were investing enough were only doing so because they had their situation analysed by a financial advisor.

This led Nicolas to team up with Seamus, an accredited financial advisor.

Together they spent countless hours to simplify typical financial advice process by combining Nicolas’s technical expertise with Seamus’s financial expertise. As a result, Horizon65 was created.

Our method is to democratise access to financial knowledge.

To achieve this goal, they developed a user-friendly tool which allows the user to become their own financial advisor. With the help of technology, the product aims to make expertise accessible, affordable and useful on a consistent basis – especially for those, who view dealing with finances as a chore.

Founder & CEO

Nicolas is an experienced fintech entrepreneur who previously founded NoviCap, Spain’s largest Fintech lender with over 1.3 Billion Euro of granted loans. The company was cited by the Financial Times as the 74th quickest growing EU Tech-company in 2019. As a former CTO, Nicolas has in-depth technical expertise when it comes to building financial products.

Founder & COO, Senior Financial Advisor

Seamus is a senior financial advisor who brings extensive experience in advising top executives and CEOs with their investment planning. Seamus carries a deep understanding of the German finance industry and financial products available to investors.

We are a Berlin-based digital company

Unter den Linden 24

10117 Berlin

Germany

Our data centres are located in Germany and certified with the ISO27001-certificate

Our company is a licensed investment broker with the registration number D-F-107-BGJA-69 in line with § 34f Abs. 1 S. 1 GewO of German banking regulations.

Broker register (http://www.vermittlerregister.info):

Registration Nr. D-3XN4-J9P4C-21 (für § 34d Abs. 1)

Registration Nr. (für § 34f Abs. 1 S. 1 GewO)

Should Horizon65 cease to exist then your finances are not affected, we only provide calculation and act as a point of contact to potential investment firms that manage your money.

Any investment you can contract through our app will be with a BaFin regulated entity that will not be affected by our bankruptcy.

Should it happen you can contract the investment firm directly or contact a traditional financial advisor to take over the communication with your investment firm.

No, we do not manage your money.

Any investment you can contract through our app will be a BaFin regulated firm. This firm will have many safeguards in place to protect your money.

Yes, we are licensed to operate as an investment broker.

Great question, we prefer to hire senior people with years of industry expertise but also with mindset to help the client.

We take complaints about our experts very seriously and have taken corrective action in the past when we realized that their knowledge or intentions did not meet our standards.

As a company we don’t take position on what you should or should not invest in.

The app includes both sustainable and traditional investment options. If you have any doubts about the sustainability of your investments you can always discuss them in depth with our experts.

The science of long-term forecasting does not work when dealing with individual investments such as shares and crypto.

By definition such investments are highly concentrated and are overly exposed to risks that could wipe out the value of that investment such as fraud (think Wirecard), cyber security risk (think Equifax), mismanagement (think Enron), market risks or even personal risks (what happens to Tesla if Elon Musk dies?).

Our clients want financial security and individual investments do not provide enough safety.

The value of individual investments over a long time is also impossible to predict.

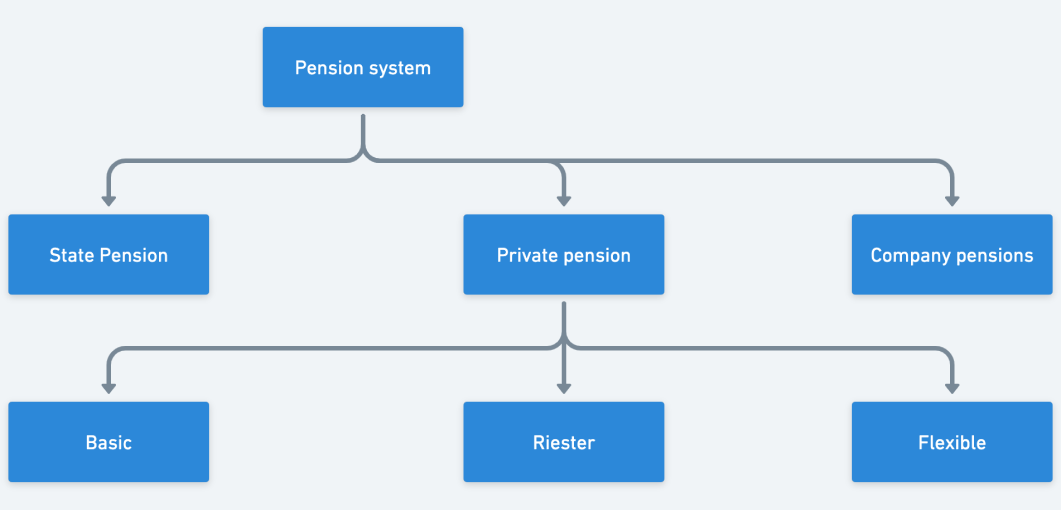

Compared to other EU countries, Germany offers you tax incentives when you invest through private pension plans.

Read more

A company pension plan (bAV) can be a valuable asset for securing your financial future as an employee. Read on to learn about the options available to you.

Read more

Real estate investing can be a great way to secure your retirement if done right. This guide is a comprehensive overview of key concepts, possibilities and risks you may encounter when making real-estate investment decisions.

Read more

ETFs, stocks and mutual funds can be used as long-term investments. In this guide we will walk you through the pros and cons of each.

Read more

Understand inflation and safeguard your wealth with our ultimate guide. Learn how inflation impacts your finances and discover strategies to protect your assets.

Read more